Clients are worried about life after retirement: Here’s how you can help

Help retirees flex their financial plans to deal with today’s challenges.

After decades of saving and planning, many pre-retirees (non-retired investors aged 55-65) are reconsidering their retirement plans in response to rising inflation, high interest rates, and an uncertain economic environment. Our Advisor Authority survey, powered by the Nationwide Retirement Institute®, revealed that one in four pre-retirees said they plan to retire later than anticipated, while another 15% are unsure if they will be able to retire at all.

According to our recent survey, a growing number of pre-retirees are worried about their financial stability in the future. Many are seeking guidance from financial professionals to get their retirement plans on the right track, hoping to discuss and address the current threats to their retirement goals.

Among the immediate challenges pre-retirees face as they consider their retirement plans, nearly two-thirds said inflation is their biggest concern, followed by a potential recession, market volatility, and taxes. When financial markets turn volatile, investors may feel the urge to alter their financial strategies. However, it’s important they consider the potential downfalls of withdrawing from the market. By staying invested for the long term, investors give themselves a good opportunity to outpace inflation.

Our survey also found that around half of pre-retirees are concerned about the long-term viability of Social Security. There’s good reason so many people are uncertain about what Social Security may look like down the road. Without legislative changes from Congress, Social Security benefits paid to individuals are likely to be lower in the future than they are today.1

Despite these concerns, 52% of pre-retirees who said they have strategies in place to avoid outliving their savings are primarily relying on Social Security. Others are looking at additional options, with 46% incorporating annuities to generate guaranteed income in retirement and help them avoid outliving their savings.

As a financial professional, you can help those nearing retirement leverage their money wisely to create predictable sources of income. This can include guiding them on the right time to claim Social Security benefits. This decision has significant implications on a client’s income over the course of retirement – which could last 25-30 years or longer for many people.

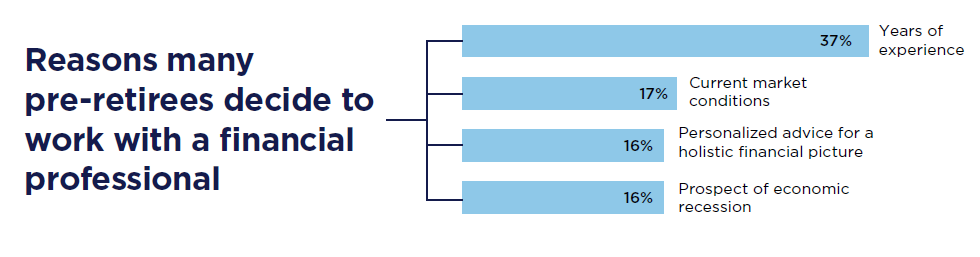

With economic factors weighing heavy on their minds and 90% of pre-retirees concerned that the U.S. will enter a recession over the next 12 months, investors are increasingly turning to financial professionals for retirement guidance. In fact, of the nearly half of pre-retirees who are currently working with a financial professional, 40% began working with them over the last twelve months.

Investors are increasingly seeking advice from financial professionals due to the care and direction they offer their clients. Of those already working with a financial professional one-third said they do so to feel more confident about their financial future.

In response to investors’ increasing appetite for financial professional guidance, almost half of the financial professionals surveyed said they’re implementing tactics to help safeguard their pre-retiree clients’ assets from market risks and ensure they have enough liquidity to cover their expenses for two years if a financial crisis occurs. As a financial professional, understanding and acknowledging your clients’ retirement goals, needs, and fixed expenses as they near retirement can lead to a long-lasting, trusting relationship.

For nearly all pre-retirees, having a plan for retirement helps them feel more in control of their financial future. By helping your clients make the right moves as they near retirement, you can help them predict and plan for the expenses they’re likely to face and feel more confident in their futures.

These three tips can help you have meaningful conversations with your clients closest to retirement:

Define their retirement goals. Do they hope to travel, own a second property, or leave a legacy to their loved ones? Give your clients a realistic picture of what it will take to achieve these goals.

Identify their fixed expenses. Help your clients understand how their assets can translate to predictable income that will help them cover their basic retirement spending needs.

Determine the right time to claim Social Security. The longer your clients wait to claim benefits, the higher they will be for the remainder of their retirement. Help them develop a plan to bridge the gap between retiring and filing for Social Security.

Survey methodology:

The research was conducted online within the U.S. by The Harris Poll on behalf of Nationwide from January 4-13, 2023, among 511 advisors and financial professionals and 789 investors ages 18+ with investable assets (IA) of $10K+. Advisors and financial professionals included 274 RIAs, 175 broker-dealers, 128 wirehouse and 55 other financial professionals. Among the investors, there were 203 Mass Affluent (IA of $100K-$499K), 167 Emerging High Net Worth (IA of $500K-$999K), 106 High Net Worth (IA of $1M-$4.99M) and 104 Ultra High Net Worth (IA of $5M+), and 209 investors with $10K to less than $100K investable assets (Less affluent). Investors included a subset of 224 “pre-retirees” age 55-65 who are not retired.

NFM-23059AO