Financial Planning for Recovering Addicts: Reclaiming Stability

Recovering addicts may face a unique set of challenges with finances. Here are tips to help your clients in recovery rebuild their financial stability

In the coming years, more people will begin to think about the costs of health care in retirement and the possibility of needing long-term care (LTC) in the future, especially as the number of Americans reaching age 65 hits an all-time high this year. That means there’s a growing need to talk about long-term care, whether it’s family members discussing care for an older parent or a financial professional meeting with a client.

The reality is, many people do want to talk about long-term care, and especially with a financial professional. That’s because they are thinking about the possibility of needing care for themselves or an older relative and don’t really know how they’ll pay for it.

How do we know this? A recent LTC survey by Nationwide found that just 36% of clients age 28+ and with $75K+ household income working with a financial professional have talked about long-term care with a professional. Clients seem to be waiting for someone else to approach the subject; the most common reason clients gave for not discussing LTC costs with their financial professional is that it hasn’t been brought up as a planning topic.

Even just mentioning the topic of long-term care with clients could lead to opportunities to strengthen existing client relationships and grow your book of business. By helping your clients prepare for this critical aspect of aging, you can provide a much-needed service, deepen client relationships, and demonstrate your value.

Our survey also revealed insights about the fears, goals, and knowledge (or lack thereof) that clients have to LTC. By bringing up these insights in conversations with your clients, you can help them feel empowered to start planning for their LTC needs.

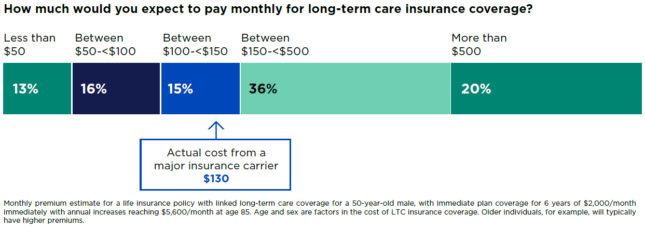

Misunderstandings about the cost of long-term care insurance keep a lot of people from considering a purchase. In our survey, almost half (49%) of respondents said the perception that LTC insurance is “too expensive” is one of the main reasons they wouldn’t prioritize purchasing the coverage. But most people overestimated how much the monthly premium for long-term care insurance coverage would cost.

When asked to estimate the monthly price of a LTC policy for a 50-year-old male with specific coverage, just 15% selected the range of $100- $150/month, which is more reflective of the actual monthly premium for long-term care coverage for this individual and scenario. Importantly, 56% estimated the premium cost would be over $150 per month, which includes 20% who guessed the premium cost would be over $500 per month, almost four times the actual cost of coverage.

There is good news, though. When told the correct average price of $130/month for that specific plan, 40% of respondents were more willing to consider buying a similar plan for themselves. This points to an opportunity for you to help clear up the confusion by showing clients what their specific LTC insurance policy would actually cost.

Not surprisingly, most people want to receive care in their own homes as they age. They know, however, that this decision could put a burden on their family or friends.

Concern about that burden on family or friends are the top reasons why clients either bought or would consider buying LTC insurance coverage. Some of the reasons they specifically chose include:

Many people also have experience in being family caregivers themselves—confirming fears about the emotional, financial and career burdens involved. Among those who have act/acted as a caregiver for loved ones at home:

Despite the challenges of caregiving (financial and otherwise), most people would still choose to be a caregiver for a loved one, even if it’s difficult. Sharing this information with your clients could open a valuable discussion about their LTC preferences, who will provide that care, the costs involved, and potential LTC insurance solutions.

Advancements in artificial intelligence (AI) could change the way people receive long-term care and reduce the financial strains placed on caregiving and aging. While almost one third of people (32%) don’t believe they will be able to afford long-term care in their home, over half in our survey (54%) expect that AI tools and robotics will be affordable for people like them to help with aspects of daily living later in life.

Americans anticipate AI tools could assist long-term caregiving in more ways than easing financial strain. Most people in our survey said they expect AI-based tools in the future to be helpful in improving quality of life and managing some administrative aspects of care.

AI-driven tools may prove to be useful in alerting caregivers that a loved one is suffering a medical emergency, or in helping them manage medications and appointments. That helps explain why some caregivers expect AI to help extend the life of the person they care for by an additional seven years.

People aged 59 and older with $75K+ household income have unique perspectives on long-term care. The top advice they would give their younger selves about planning for LTC is to start to save (47%) and plan (36%) earlier.

As a trusted financial professional, you have a unique opportunity to help your clients act on that advice. By initiating the conversation, you can help them:

It may seem daunting to “break the ice” with clients in talking about long-term care planning. One way to ease into the discussion is to ask clients how their parents and other family members are doing. You can also relate your own personal experiences with older parents and other relatives, or share stories from other clients (keeping any personally identifiable details to yourself, of course.)

The most important step you can take as a financial professional is to proactively communicate with clients, ensure they understand the costs, and develop a long-term care plan that accounts for their anticipated needs, as well as those of their loved ones.

The research was conducted online in the United States by The Harris Poll on behalf of Nationwide among 1,334 adults ages 28+ with household income of $75K+. The survey was conducted March 12 – April 2, 2024.

Data are weighted where necessary by age by gender, race/ethnicity, region, education, marital status, household size, household income, and political party affiliation to bring them in line with their actual proportions in the population. Respondents for this survey were selected from among those who have agreed to participate in our surveys.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 3.8 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

NFM-23927AO.1