Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Even with some notable dips and rallies, the S&P 500® Index has trended mostly sideways over the past two years. At the end of May 2021, the benchmark large-cap index stood at around 4,200, then fell to 4,132 by May 2022 (a decline of just 1.7%). By the end of May 2023, the S&P 500 was at 4,179, not much higher than where it was one year earlier.

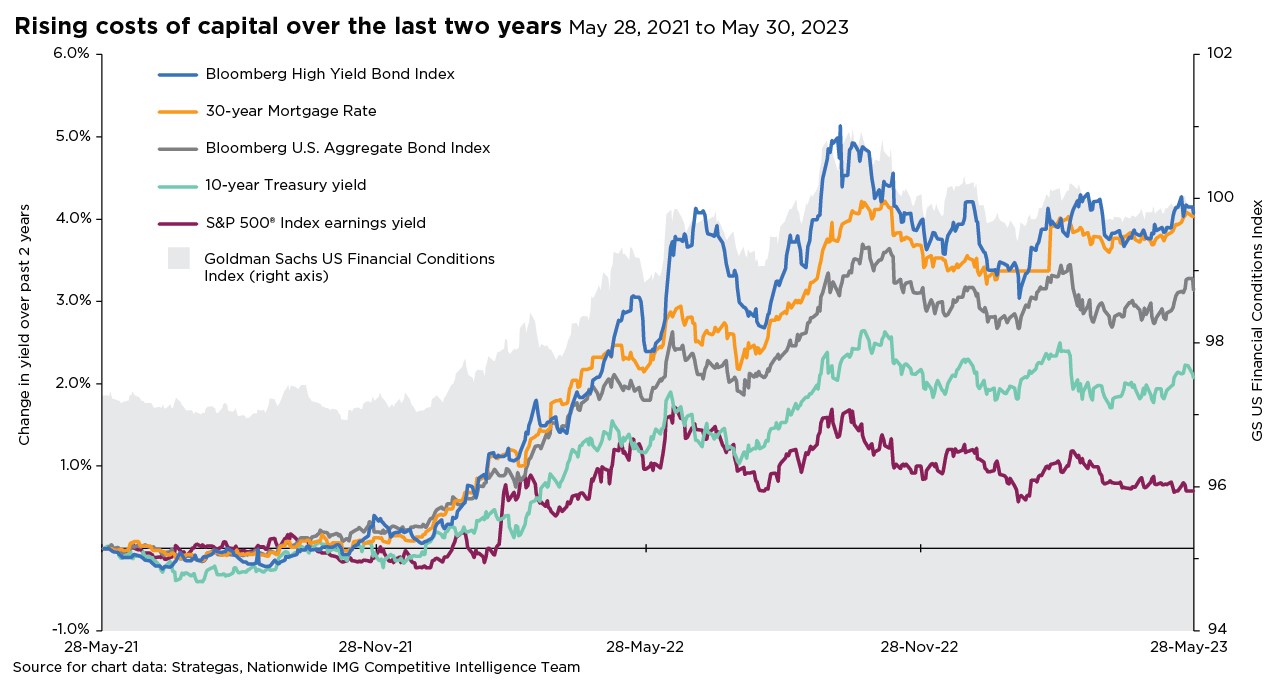

This kind of directionless movement can frustrate stock market investors. But the same hasn’t been true for interest rates over the past two years. By many measures of fixed-income market performance, interest rates haven’t been as range-bound as stocks. This rate of change for the cost of capital has several implications for investors.

First, higher capital costs will likely make it untenable for smaller, unprofitable companies to fund future capital expenditures. Second, a higher cost of capital may impact debt-service coverage ratios for less-creditworthy corporates. Finally, the recent rise in interest rates will affect the economic well-being of the U.S., as highlighted in the current political debate over raising the federal government debt ceiling.

A higher cost of capital makes managing a national debt of around $31.4 trillion a challenge. In Q1 of this year, the average interest rate paid by the U.S. government on its outstanding debt rose to 2.9%. This average is the highest in over a decade and might become a worrisome trend in the coming years if interest rates remain at current levels.

As the cost of capital rises and debt servicing costs increase, investors should focus on quality companies with ample cash reserves and robust cash flow generation that can quickly meet debt-servicing obligations. With rates and yields likely to stay elevated, both interest income and interest expense for companies’ balance sheets will likely increase in the coming quarters. Companies with cash-rich balance sheets saw better Q1 earnings results. At the same time, those firms with high leverage and refinancing risk have generally underperformed. Diversification within a portfolio can also help lower concentration risk as the rate outlook remains uncertain.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1471AO