Q2 earnings: Continued strength supports the stock market bulls

A solid showing for corporate earnings last quarter shows that the fundamental backdrop remains supportive for stocks.

Stock investors have enjoyed a strong and steady rally from the market’s October 2022 lows, but some may wonder what catalyst could propel stocks higher from here. One potential catalyst for further stock gains may be coming soon: the second-quarter earnings season, helping to bolster fundamental trends and validate that FY 2024 consensus estimates are attainable as the second half of 2024 unfolds.

The resilience of the rally is notable when one looks at the Index. Still, a deeper look into the market reveals a massive divergence in performance—incredible returns for the largest S&P 500® Index companies but weakness among individual stocks. This has become a key theme for the equity market in 2024. Moreover, economic reports have been split between the positive (e.g., resilient GDP growth, robust labor markets) and the negative (e.g., persistent inflation, higher-for-longer interest rates). These divergent readings may make it challenging for investors to navigate the market’s future direction.

As the second-quarter earnings season kicks off later this week (with the big banks JPMorgan and Citigroup due to report on July 12), it’s important to note that estimates for the quarter and the 2024 calendar year have been relatively stable. That would likely lead investors to demand that firms deliver more earnings “beats” (i.e., when earnings surpass analyst estimates.) Further estimated year-over-year earnings growth rate is projected to be around 8.0% for Q2, 7.5% for Q3, and a significant increase to 17.2% for Q4, according to FactSet.

We expect the “Magnificent 7” firms to account for most of the earnings growth for the S&P 500 in the second quarter, but this growth is likely to converge toward the other 493 stocks in the Index, starting with the earnings reports for Q3 and Q4 later this year. However, the potential for weaker earnings growth for the Magnificent 7 is a big risk to the bullish narrative for stocks. This risk could be compounded if the anticipated earnings growth for the remaining 493 companies in the S&P 500 fails to materialize in the next two earnings seasons.

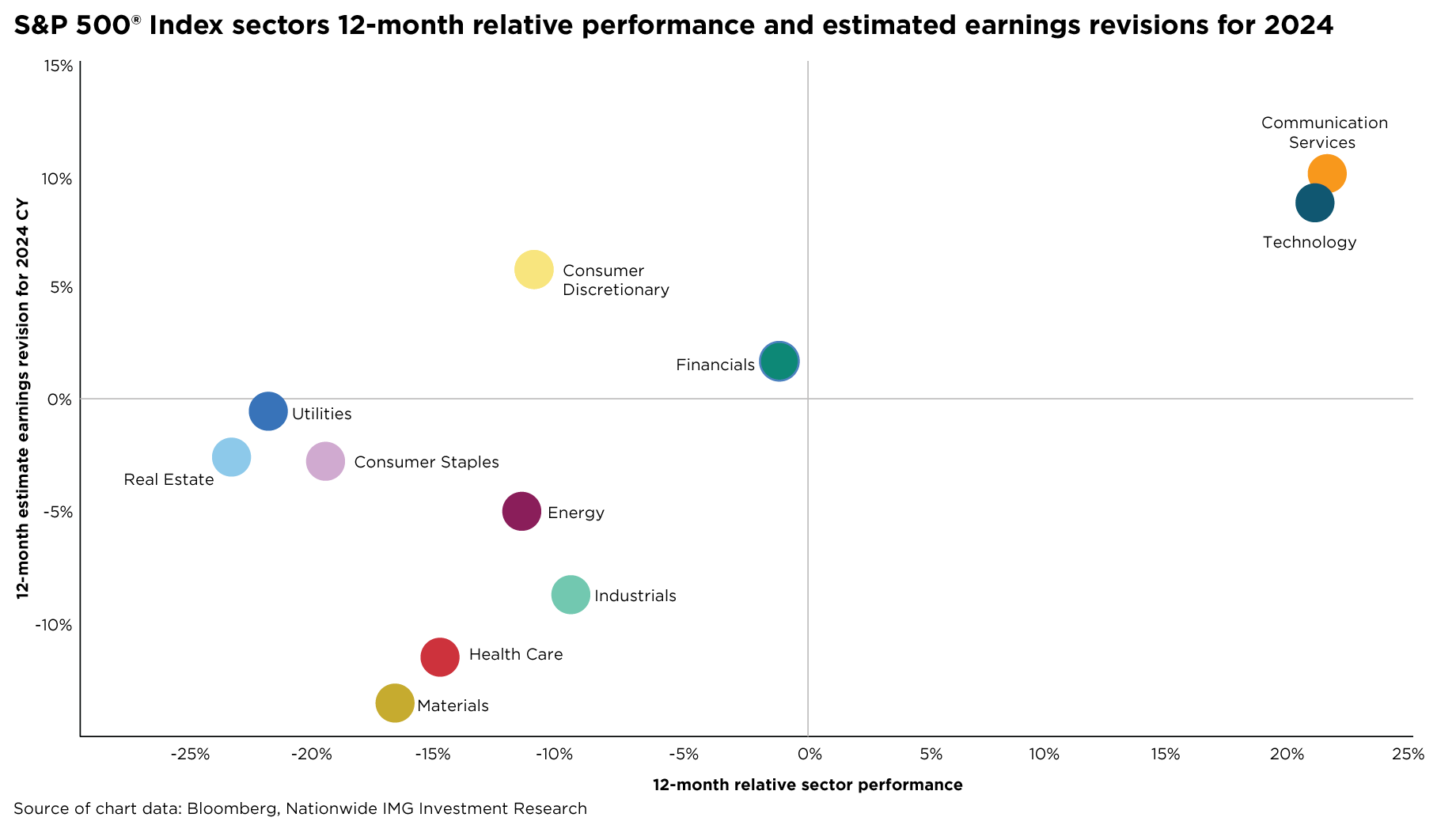

As the accompanying chart illustrates, relative performance among S&P 500 sectors over the past 12 months has been broadly in line with earnings growth revisions. At first glance, this may create angst among investors as most sectors have underperformed the S&P 500, but that’s mainly due to the outperformance of a handful of mega-cap stocks. Steadying or increasing earnings estimates for the 2024 and 2025 calendar years might signal the start of a new earnings cycle, which could boost the values of the remaining 493 stocks in the S&P 500 Index. Additionally, this year’s earnings recovery story is primarily attributed to improved margins. Historically, sectors with high operating leverage, such as materials and industrials, tend to benefit as margins improve.

The potential for broader earnings recovery will be heavily scrutinized throughout the upcoming Q2 earnings season. The concentration of earnings growth, waning economic growth, and signs of moderating consumer spending have some investors worried about lofty earnings estimates for 2024 and 2025 and, therefore, the sustainability of the market rally. However, the dual tailwinds of expected Federal Reserve rate cuts and economic normalization may help propel the ongoing bull market and lead to more relative earnings growth supporting the broader market.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1669AO