Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Stocks ended 2023 in a flourish, defying market volatility, economic uncertainty, and recession worries to reel off nine consecutive weeks of positive returns and finish the year with a gain of nearly 26%. While most stock bears pointed to the narrow leadership profile of the market in 2023, when a handful of large tech stocks powered much of the rally, a notable shift occurred around the start of November. The turning point occurred as investors grew more confident that the Federal Reserve was done hiking rates for the current cycle.

At the start of November, the S&P 500® Index was up around 10% on a capitalization-weighted basis for the year to date, while the S&P 500 Equal Weight Index was slightly down for the year to date. After a confluence of positive economic reports affirmed the downward trajectory of inflation, market performance began to broaden, with the S&P 500 Equal Weight Index outperforming the cap-weighted index in the last two months of the year.

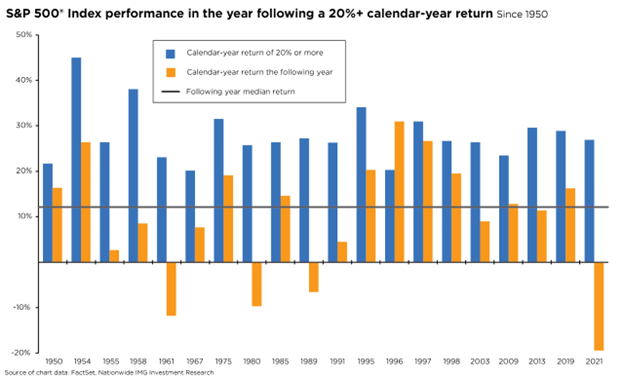

For stock investors, the year-end rally was the icing on the cake, especially after the dire market outcome of 2022. But as we enter a new year, many investors may wonder if stocks can sustain this momentum. The historical record offers some clues; since 1950, the S&P 500 has been positive in around 80% of the years following a 20% or more annual gain for the benchmark index, with a median return of 12.1%.

While history may not repeat in this manner in 2024, it may give investors reasons for optimism about the road ahead. Obstacles will undoubtedly appear, but many fundamental factors, such as moderating inflation, positive trends in corporate earnings, and a potential pivot to Fed rate cuts, are present to support the case for the stock market bulls.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1567AO