Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

The S&P 500® Index suffered a minor pullback between July and October, dropping below its 40-week moving average and raising concern among bullish investors. During this period, several important market indicators similarly were in play to last year’s market drawdown, culminating in what many market participants believe to be the bear-market low on October 12, 2022.

In 2022, as the S&P 500 approached the bear market low, several contrarian market signals flashed red, including dour investor sentiment, oversold indexes, positive breadth divergences, and tight financial conditions. The near-universal pessimism that coincided with the bear market bottom might have been a contrarian buy signal. Interestingly, similar market indicators flashed red during the July-October 2023 drawdown. Since then, the S&P 500 Index has rallied over 6% as of this writing.

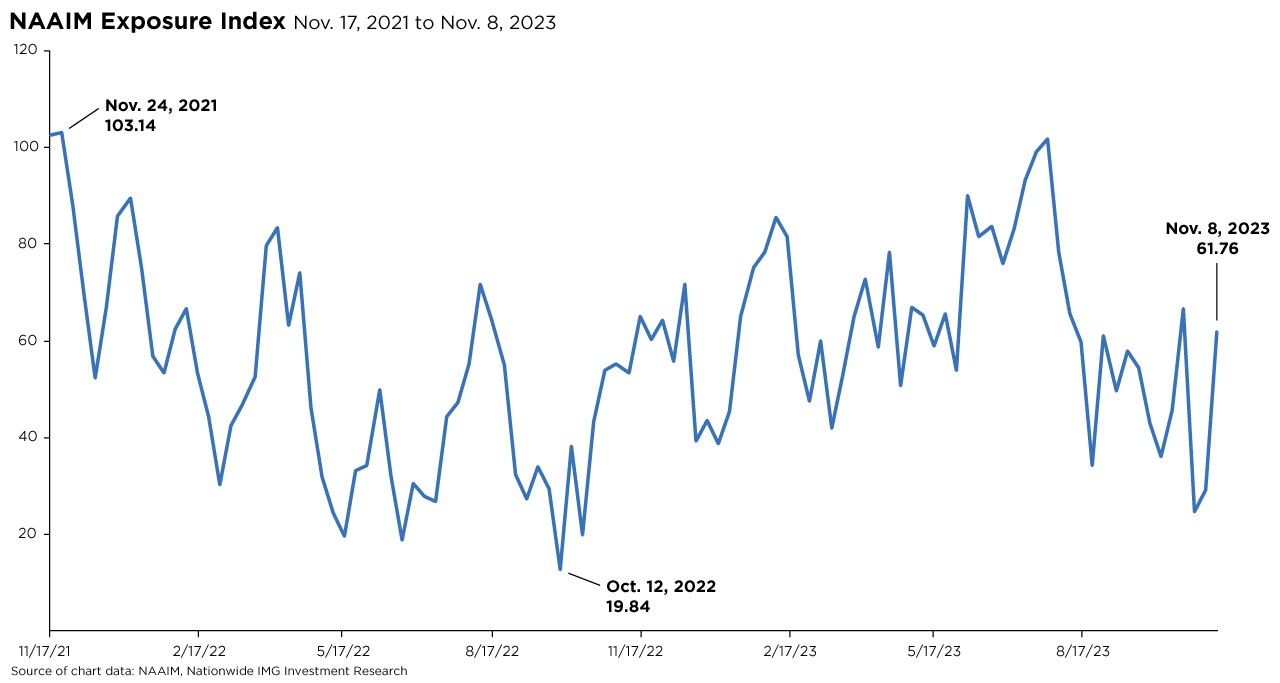

It’s reasonable to assume that the conditions during the 2022 drawdown echoed those during the July-October 2023 drawdown. First, there were clear signs of panic from individual investors, as depressed sentiment and positioning indicators, as represented by the AAII bull-bear spread, showed that investors were likely too bearish. Second, the NAAIM Exposure Index (a measure of sentiment and positioning) tumbled from its July high of 101 toward a nearly oversold, contrarian bullish level of 24 on October 25.

Third, Bank of America’s Bull & Bear Indicator recently hit its lowest point since last November—an extreme bearish level that could be read as a contrarian buy signal. Fourth, tighter financial conditions, recession fears, and the lagged effects of Fed rate hikes continued to weigh on investors—a climate that also impacted investors in the 2022 downturn. It’s important to mention that the sharp decline in the 10-year Treasury yield in October played a crucial role in the stock market’s recovery, helping the S&P 500 notch eight consecutive days of gains from October 30 through November 8.

November through December is historically the best two-month period for equities so that a year-end rally might be possible. However, even repeatable patterns in market indicators should be taken with a grain of salt. It remains vital for investors to focus on the long term and maintain a diversified portfolio that can weather short-term fluctuations in the financial markets.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

The National Association of Active Investment Managers (NAAIM) Exposure Index is a valuable tool that helps investors gauge the sentiment of active investment managers in the stock market. The NAAIM Exposure Index shows how active risk managers have changed their clients’ accounts over the past two weeks.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1548AO