Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

There has been a remarkable shift in interest rate expectations within the last month as the Federal Reserve has indicated it’s in no hurry to cut rates. With economic data proving to be more resilient and the pace of disinflation appearing to be moderating, a more cautious tone has emerged from various Fed officials.

For example, Kansas City Fed President Jeff Schmid recently stated that “the best course of action is to be patient, continue to watch how the economy responds to the policy tightening that has occurred, and wait for convincing evidence that the inflation fight has been won.” Overall, inflation will likely move closer to the Fed’s 2% inflation target over time. However, recent evidence of a potential recovery in cyclical data might challenge the disinflation narrative.

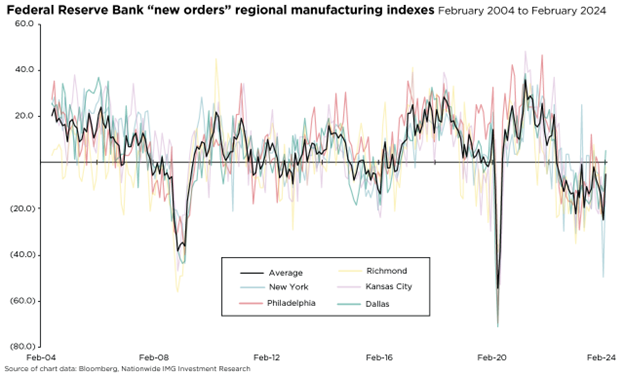

For instance, both the ISM Manufacturing Index and Markit Purchasing Managers’ Index (PMI) are beginning to show signs of an early recovery, albeit modest. Furthermore, when reviewing various regional manufacturing surveys conducted by the Federal Reserve, specifically the “New Orders Index” subcomponent for each survey (see accompanying chart), a reacceleration in growth might complicate the disinflation narrative.

The potential inflection of manufacturing data has several implications for investors. First, the backdrop of a cyclical recovery might keep upward pressure on bond yields and increase market volatility related to expectations for a continuation of tighter Fed policy. Second, for equities, the undercurrent of a cyclical recovery should be positive for earnings, balanced against the need for equity valuations to adjust to the potential for a more hawkish Federal Reserve. Third, upcoming economic reports bear watching should data remain resilient or begin to reaccelerate. The Fed has never cut interest rates with an accelerating PMI backdrop.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1595AO