Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Market narratives, such as artificial intelligence or seasonal trends, can help investors understand and navigate its complex dynamics. As one example, September has historically been the most challenging month for stock returns compared to all other months, so many investors wouldn’t be surprised to see the S&P 500® Index stay in a range of 4,300-4,600 in the short term. Concerns over economic growth or corporate earnings could send the market below this range. Conversely, better GDP numbers or earnings upgrades could help the index break above this range.

Sometimes, market narratives can be overly simplistic or misaligned. Exploring factor investing is another approach that could help investors gain insights into market trends and asset class performance.

Factor investing involves targeting securities with specific characteristics like value, quality, momentum, size, and low volatility. Two main factors tend to drive returns: macroeconomic factors that capture broad risks across asset classes and style factors that explain return and risk within asset classes. Investors can use factors as a magnifying glass to better understand what’s influencing market performance.

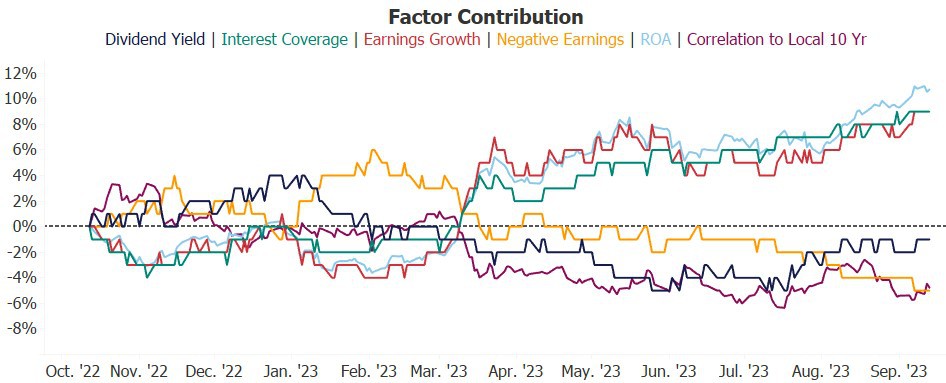

To illustrate, let’s consider the factors that have powered stock performance from the October 2022 bear market low (assuming that was the low) to the present day. Generally speaking, the factors that have outperformed since the October low (see the accompanying chart) imply that investors believe we’re at the peaks of inflation and interest rate tightening rather than the beginning of a sustainable economic recovery. If the economic cycle was recovering, a factor like the interest coverage ratio should generally underperform, and more risk-oriented factors would outperform. Moreover, as credit conditions continue to tighten and monetary policy evolves, investors generally favor quality-oriented factors like positive earnings growth or return on assets. The chart illustrates that investors have preferred these two factors since the October lows.

Another intriguing theme over much of the past year is the underperformance of dividend-yielding equities. This makes sense, given the competition these stocks now face from higher-yielding bonds. For example, the yield on 3-month Treasury bills (considered a cash equivalent due to its short-term safety) is now higher than the earnings yield of the S&P 500. That should make stocks less attractive than cash. Although factor performance might explain market sentiment or investor preferences, there’s no guarantee that funds seeking exposure to specific factors will improve performance or reduce risk. Even when considering factor investing as part of an investment strategy, it’s important to maintain a well-diversified portfolio.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1523AO