Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Regarding geopolitical conflicts, every situation is unique and often highly opaque. There are no roadmaps that investors can rely on to judge the potential spillover effects from sudden geopolitical shocks. One thing is certain: as geopolitical tension rises, so does the potential for stock market volatility.

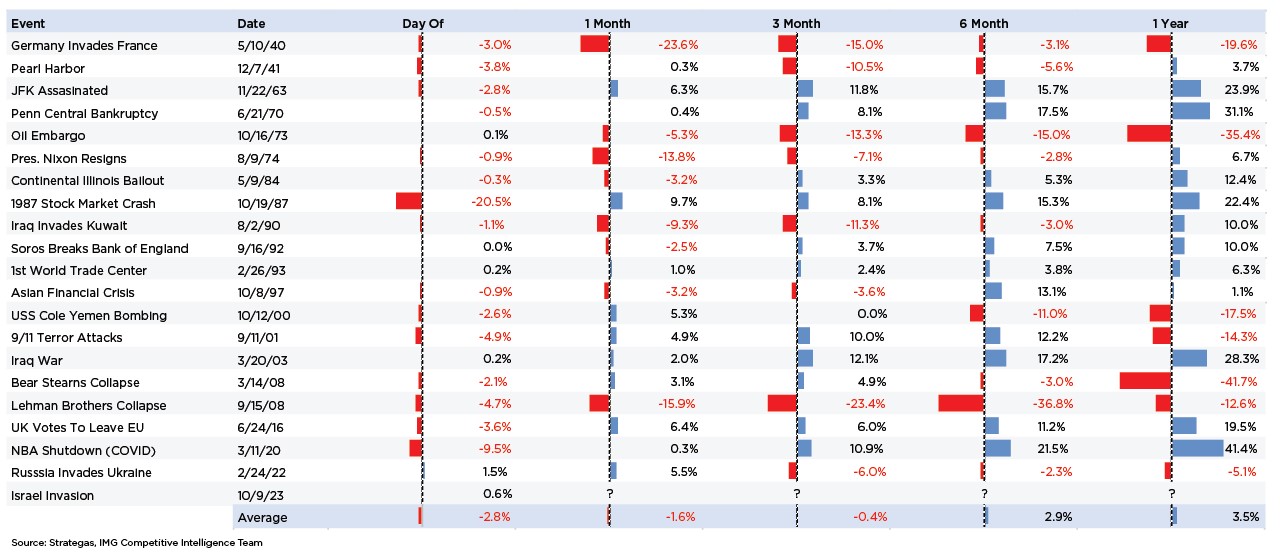

Investors generally understand all investments carry some element of risk, including political, economic, and geopolitical risks. Moreover, just as bursts of volatility can arise at a moment’s notice, geopolitical conflicts usually erupt suddenly, sparking panic among some investors. But using history as a guide, investors can assess the potential impacts on the financial markets to navigate macro uncertainty better.

The accompanying table lists a series of significant historical events along with the performance of the S&P 500® Index over different periods following each event. There are several interesting observations. For one, each geopolitical event varies in scope and duration. Second, and arguably a critical nuance for investors to consider, stock market volatility during these events can also include market drawdowns and recessionary conditions, sometimes occurring independently of the geopolitical event and highlighting the interplay of different risk factors. For example, the USS Cole Yemen Bombing and the September 11 terrorist attacks in 2001 overlapped with the dot-com stock crash between March 2000 and October 2002.

While the past doesn’t always serve as a reliable future template, patterns often arise that allow investors to conclude that stocks eventually recover from major geopolitical shocks. Investors’ initial reaction to geopolitical events is understandable, as the headlines and initial market volatility usually dominate investor sentiment. Underlying factors, however, like corporate profits and economic growth, ultimately drive the market’s long-term performance. Investors should remember that markets are resilient and have rewarded those long-term investors who stick with a well-crafted financial plan.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1533AO