Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Last week marked nine months since the October low for the S&P 500® Index. The benchmark large-cap index has increased by over 25% since that low. This is a solid gain, especially compared to the average nine-month gain after major correction lows when there’s been no recession, according to Strategas.

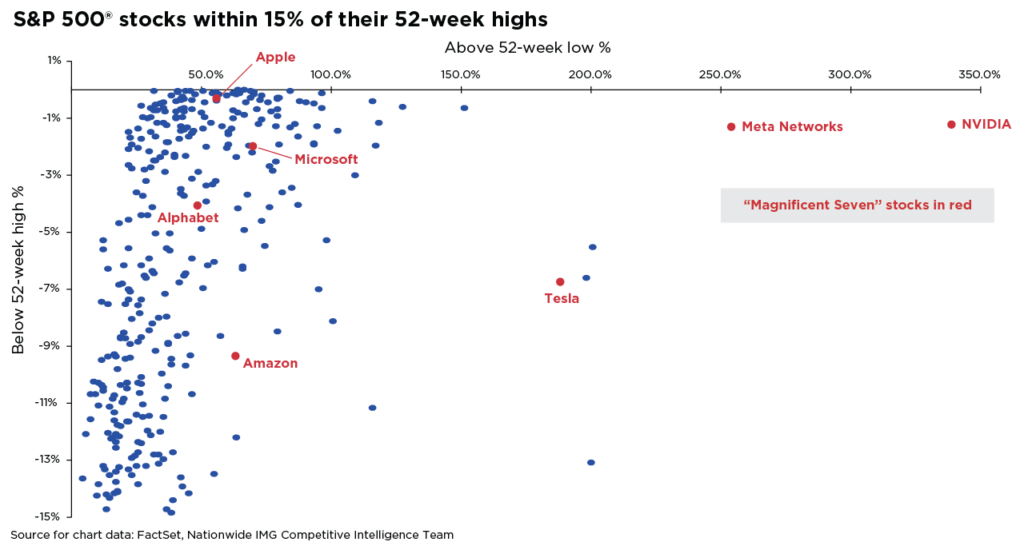

Prevailing market sentiment could be explained as “FOMO” – fear of missing out on market gains from investors who responded by chasing momentum. Much of this momentum is due to the performance of the “Magnificent Seven” stocks – Apple, Microsoft, Amazon, Alphabet, Meta Networks, Tesla, and NVIDIA – contributing to 73% of the S&P 500’s gain in the year’s first half. Each of those stocks was up 90% on average for the year to date through June 30.

Additionally, allocations to U.S. equities have soared, reaching the highest levels this year. At the same time, the put-call ratio, which gauges stock market sentiment by examining trends in options trading, has dropped to its lowest point since January 2022, indicating sentiment has become more bullish. However, to the stock market bears, FOMO is a contrarian indicator, displacing fundamentals and setting the stage for trouble.

Investors who sold out of equities due to an overly pessimistic perspective will likely wrestle with a profound sense of FOMO if market breadth expands. The potential for improving market breadth is illustrated in the accompanying chart and challenges the bearish view. Approximately 350 stocks in the S&P 500 are within 15% of their 52-week highs. Further, with the S&P 500 nearing its January 2022 peak, investors who sat out this year’s rally may now be feeling trepidation.

Investors should avoid succumbing to FOMO trading to make wise investment decisions, which is usually an emotional response to price momentum. Instead, investors should assess the current strength of the rally and seek to expand their portfolios to include other areas of the market, not just the popular “Magnificent Seven” stocks. A well-crafted investment strategy designed to downplay emotional decisions is crucial to maintaining portfolio balance and achieving long-term financial goals.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1496AO