Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

It’s no secret that there are alternatives to stocks with money market yields over 5%, tempting investors that have endured over a decade of zero-bound interest rates. Arguably, holding cash, or “dry powder,” might look compelling as an alternative to the S&P 500® Index. After all, the market’s erratic nature and uncertain economic landscape begs the question: should investors ditch equities and park their portfolio in a predictable, near-risk-free alternative sporting a respectable yield of over 5%? Although every circumstance differs, this is generally not a prudent portfolio strategy. While using short-duration vehicles for short-term goals is prudent, it is important to emphasize the need for a well-diversified portfolio and avoid the temptation to “hide out” in cash-like instruments.

Money market funds offer investors a range of benefits, including stability of principal, liquidity, and current income. It’s worth noting, however, that these funds are not a suitable replacement for long-term capital growth strategies. Remember that cash is not a risk-free investment, as inflation is likely to erode not just the gains from interest income in a money market account but also the principal investment in a money market fund.

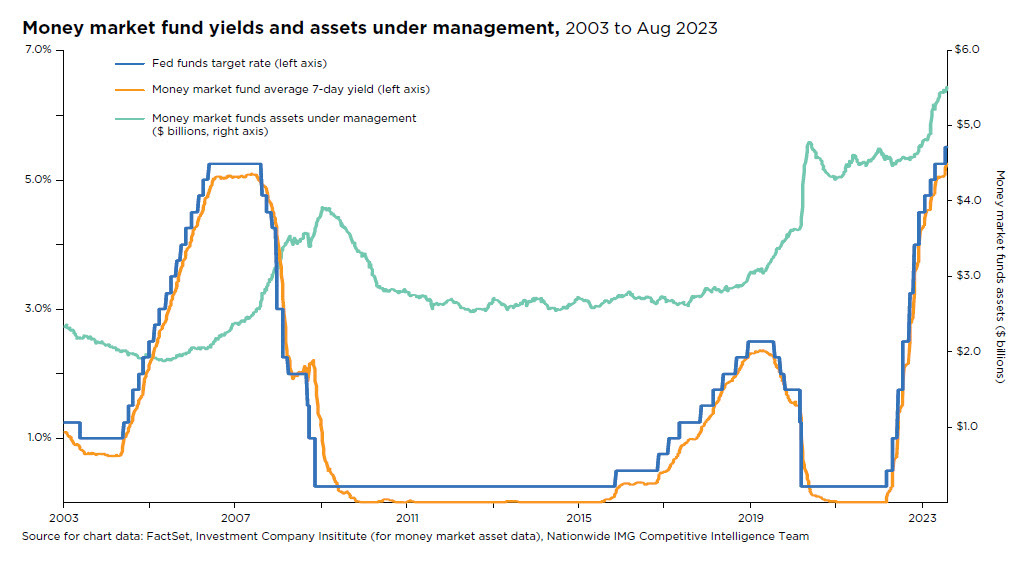

Allocating long-term investment dollars to short-term investment products to avoid market volatility opens the door to reinvestment risk. As depicted in the accompanying chart, the relationship between the Federal funds rate and money market assets under management is relatively straightforward. As the Fed funds rate increases, assets under management in money market funds also increase. But once the Federal Reserve begins to cut rates and yields on money market funds fall, investors start to reallocate their portfolios to stocks or alternative investments. The forward-looking equity market has likely advanced well before an investor can identify the upward trend.

Another way to consider this choice is to ask how much interest income an investor would need to match what stocks have done so far in 2023? Let’s take someone with $1 million to invest and an overly pessimistic view of stocks. Investing this $1 million in a money market fund yielding 5% would net a year-to-date dollar gain of roughly $30,000. But if this investor had allocated $1 million to the NASDAQ Composite Index at the start of the year, the dollar gain so far would be around $310,000. To match the same return in a money market fund yielding 5.0% would take nearly ten years. And that’s only if money market yields remain constant, which doesn’t happen.

Short-duration vehicles such as money market funds are appropriate for short-term goals, but longer-term goals require investors to assume some risk to seek returns above the inflation rate. Investors should have a strategy delineating short-term cash liquidity needs versus long-term investment needs. Investors must also remain committed to their long-term strategies to tap the potential of substantial capital appreciation. This is especially important during periods of market volatility.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

NASDAQ Composite Index: A stock market index of the common stocks and similar securities (e.g. ADRs, tracking stocks, limited partnership interests) listed on the NASDAQ stock market.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1506AO