Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Before the pandemic, several dynamics in the global economy—quantitative easing and demographic trends, among others—placed downward pressure on interest rates. Fast-forward to this year, the trend has effectively reversed; the Federal Reserve has hiked the Fed funds rate from zero-bound to the 5.25-5.50% range, yet the economy (at least for now) remains resilient. There is debate among economists and various Fed officials that the neutral rate of interest is higher than once thought. R-star or R*, which is shorthand for the neutral rate of interest is defined as the level of real short-term interest rates (after inflation) that allows for steady economic growth while keeping inflation in check.

Some parties in the R-star debate argue that eventual productivity gains through artificial intelligence (AI) will allow the neutral rate to remain elevated. However, the counterargument states that the productivity collapse in 2021-22 likely won’t be saved by AI in the short term, so the neutral rate would have to be lower.

R-star is hard to observe and measure. Federal Reserve Chair Jerome Powell acknowledged as much in the closing message from last month’s Jackson Hole conference: “As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical.” Further comments from New York Fed President John Williams bolstered this point: “There is no evidence that the era of very low natural rates of interest has ended, and the impact of the pandemic on estimates of what is called R-Star so far appears relatively modest.”

Front and center is the credibility of the Fed to get inflation back to its stated 2% inflation target. Again, at Jackson Hole, Powell did everything he could to convince the market that the inflation target is and will remain at 2%. So, this debate will continue inside the Fed and among outside economists as time evolves with several possible paths: for one, over the next few years, higher but not restrictive rates will prevail; two, low rates will prevail due to some exogenous shock; or three, structural changes in the economy such as ending the era of cheap goods, energy, and labor allows higher rates to become the new paradigm.

An interesting juxtaposition has recently emerged between macroeconomic data and Treasury yield curves. When economic data has been good as of late, yields have risen. Likewise, when economic data comes in weaker than expected, yields decrease, signaling belief among investors that the Fed will not have to hike rates or keep rates restrictive longer than necessary. For example, a string of reports last week—a drop in job openings, lower consumer confidence, and a slightly lower second-quarter GDP number—helped rates ease from their recent peaks. An apparent weakness in the recent data led to a reprieve for the 2-year Treasury yield, which is often used as a proxy for the federal Funds target rate. However, rising federal government deficits and debt levels might make interest rates stickier.

Ending the era of low-interest rates has implications for “zombie companies” that have benefited from the prevalent “free capital” during this period. The increasing cost of capital has created a split between companies that have termed out their debt and those that have yet to. Many market observers note that spreads between investment-grade and high-yield corporate bonds are below their historical averages. The risk of higher rates begins to emerge when companies’ refinancing needs clash with higher rates, something most existing credit issues will experience around 2025. For now, default risk is priced in.

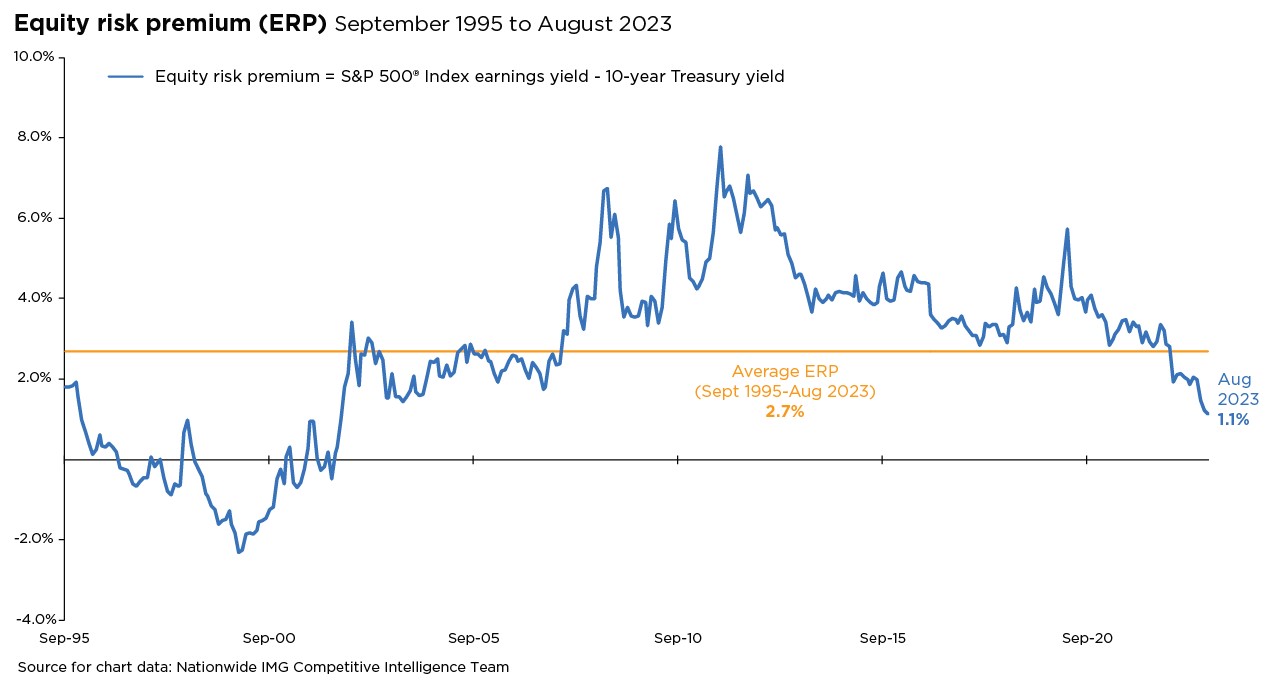

Lastly, higher rates, should they prevail, should eventually act as a headwind for stocks, although at what level is unclear. Some signs of this are already present, including the historically low equity risk premium (i.e., the difference between expected equity yields and bond yields; see chart on the previous page), real rates at their highest levels since 2008, and rising term premium across the curve. Unlike the post-global Financial Crisis period, the compensation for taking risks seems narrower as investors have safer alternatives.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1516AO