Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

The U.S. presidential election is nine months away, which may seem like an eternity. Still, for market sentiment, the specter of the impending election casts a shadow of uncertainty over the financial landscape. With the relentless churn of the news cycle and social media noise, polarization seems to loom large, fanning the flames of anxiety and apprehension among many investors. Fusing these potent elements with investment decisions can create a volatile mix where emotions reign supreme, and rationality takes a backseat. Amid this upheaval, investors will likely grapple with conflicting messages, impulsive decisions, and the allure of trading short-term gains.

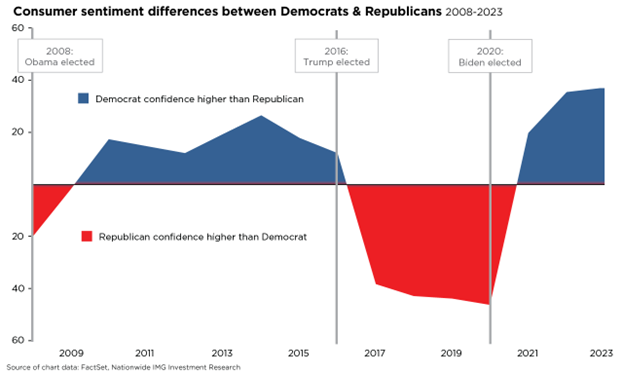

Like market narratives, investor sentiment can be driven by deeply held beliefs and cling to the irrational. Often, these beliefs can outlast the solvency of those who adhere to them, irrespective of political affiliations. Investors should understand that financial markets typically exhibit a minimal response to both presidential and mid-term elections. As the accompanying chart demonstrates, emotions associated with political affiliations make perceptions of the economic or capital markets landscape appear disjointed; the result can potentially increase market volatility and, at worst, create an apathetic view toward long-term investing.

Investors should refrain from changing their investment strategies in anticipation of post-election market swings or based on investor sentiment surveys. Doing so can contribute to significant losses and lead investors astray from their long-term financial goals. Instead, investors should stick to a well-thought-out investment plan and avoid impulsive decision-making based on election outcomes. That’s the best path for a more secure and stable future.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1588AO