Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

This past April has been cruel for stock investors, with the S&P 500® Index slipping 5.5% over the first three weeks of the month (April 1-19). The recent decline garnered headlines mainly because it interrupted the bull market’s impressive run over the last six months.

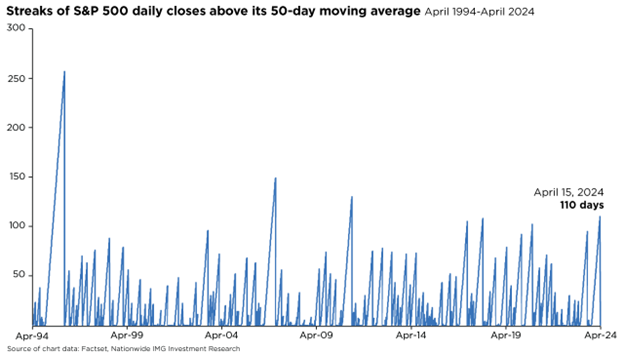

On April 15, the S&P 500 closed below its 50-day moving average for the first time since last November. That’s the longest streak since 2011 and the fourth-longest in 30 years. (See the accompanying chart.) But the drawdown also underscored the growing risk of a decline in a strong bull market. Investors should remember that losses and gains are integral to the market’s dynamics. Pullbacks often help recalibrate investor sentiment when it gets too bullish, tempering optimism and aligning underlying valuations with fundamentals.

Different economic and financial currents converged in recent weeks to help set the stage for the stock market turbulence. First, volatility moved higher, notably as the VIX volatility index surged above 19 for the first time since October, highlighting how much investor sentiment has recalibrated. Second, rising geopolitical tensions pushed commodity prices higher, underscoring the threat of sticky inflation. Third, resilient economic data contributed to the increase in bond yields as investors adjusted to the reality of delayed Federal Reserve rate cuts (with the potential that rate cuts may not come at all in 2024.) However, despite the causes of turbulence, the fundamentals supporting the market seem intact.

While the April drawback was notable and painful, 5% declines in the stock market are quite common; they’ve happened 28 times since 2009, or around twice a year on average. Even so, the fundamental backdrop of positive earnings growth and resilient economic data should motivate the current bull market to continue. Long-term investors should remember that volatility is normal and that time in the market—not timing the market—ultimately drives portfolio performance.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1628AO