Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Investors have been riding what can best be described as an “everything rally” during the first months of 2024. Not only have U.S. stocks soared to new highs, but Japanese and German stocks have also climbed to fresh records. The S&P 500® Index has risen in 16 out of the last 19 weeks, surging to an impressive gain of over 20%, but a minor hiccup on Tuesday, March 4, caused some investors to question the recent uptrend. The 1% decline, which was only the third daily decline of 1% or more this year, gave some fodder for the bears.

Since 1928, the average year has typically seen around 29 declines greater than 1%, which prompted some investors to question if stocks and other risk assets were priced to perfection. Some analysts warned of a frothy market, citing the recent Bitcoin rally and resurgence of speculative technology ETFs as potential precursors to a market correction. (A correction is usually defined as a drop of more than 10% but less than 20%.)

Whispers of a market “bubble” began circulating among the bears, fueled by apprehensions that markets may have surged too rapidly. Additionally, some bears argued that the solid bullish sentiment from discretionary and systemic investors might offer a contrarian signal. Nonetheless, it’s essential to remember that market corrections—large or small—are a natural part of the investment cycle.

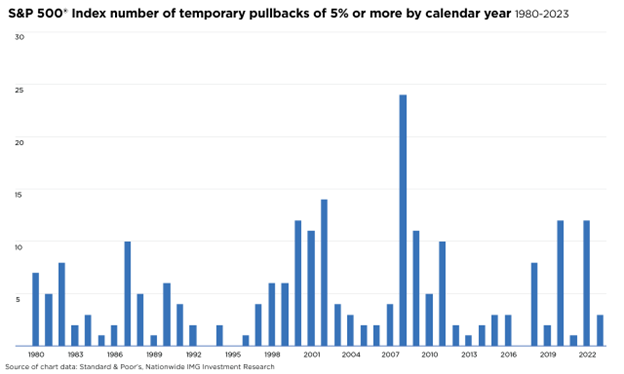

While the recent 4-month rally can conceivably continue because of favorable economic and fundamental tailwinds, we should acknowledge the historical trends; since the 1980s, the market has experienced a temporary decline of around 5% or more almost yearly. Rather than trying to predict corrections, consolidations or market peaks, which both the bulls and bears love to debate, investors should prepare for potential market volatility by ensuring their portfolios are aligned with their risk tolerance. By staying disciplined and sticking to a long-term investment strategy, investors are equipped to navigate the inevitable ups and downs of the market.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1600AO