Q2 earnings: Continued strength supports the stock market bulls

A solid showing for corporate earnings last quarter shows that the fundamental backdrop remains supportive for stocks.

We’ve noted previously that stocks are in a period of relative calm right now. The S&P 500® Index has gone 18 months without a single day sell-off of 2% or more, the longest streak since the Global Financial Crisis. There have only been nine days in 2024 when the S&P 500 has fallen more than 1%.

This lack of volatility is corroborated by the VIX (an index that gauges investors’ expectations for ups and downs in the S&P 500), which has averaged 13.8 this year and is on pace for its lowest annual reading since 2017.

Throughout the first half of the year (and even further back to the start of the current bull market in October 2022), stocks have climbed the proverbial “wall of worry”; investors have had plenty to worry about, from recession fears to higher interest rates, lofty valuations, and the latest worry, top-heaviness in the market. These concerns haven’t dented the momentum for stocks, but can it continue? Let’s look at some data to explore the possibilities.

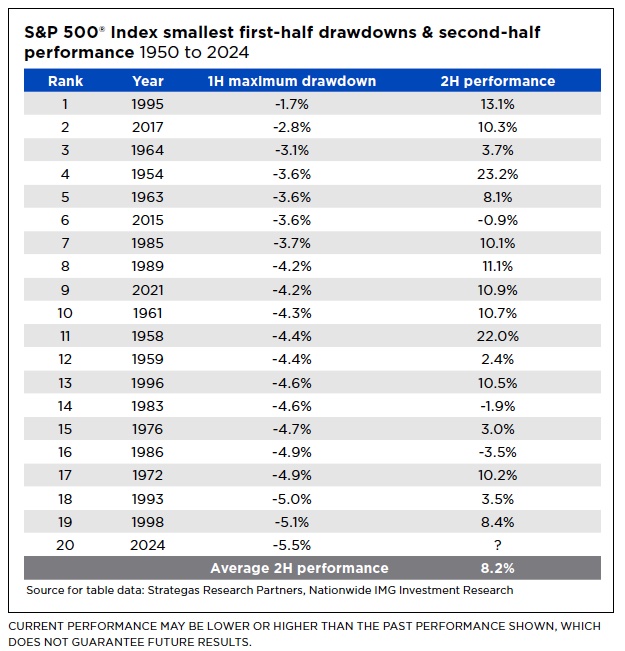

We’ve had one downturn in 2024 that could be considered mild—the 5.5% decline for the S&P 500 in April. As the table shows, this drawdown was benign relative to the smallest first-half downturns with data from the 1950s. Plus, when the S&P 500 gains 10% or more in the first half of the year (as in 2024), the second half is positive 88% of the time, with an average six-month gain of 8%.

Moreover, the S&P 500 had not experienced a single-day sell-off of more than 0.41% since May, although that changed on July 11 with the release of the latest inflation report, showing consumer prices rising at their slowest rate since last June. The S&P 500 dropped 0.9% that day, but nearly 400 stocks in the Index closed higher. A broadening of positive performance may give some investors hope that the market’s momentum will stretch beyond the handful of large-cap tech stocks that have powered performance this year.

For a bearish take, consider that the cumulative return for the current bull market (since October 2022) is still about 20 percentage points below the median bull market gain of 76.7% (since 1929.) The over-concentration of market returns coupled with the current relative tranquility might give some investors pause as they watch the major indexes make higher peaks despite the lack of breadth. Unlike the weather, markets don’t have to be calm before the storm.

But much like weather, markets are impossible to predict. The first half of 2024 was the 14th-best first half since 1950—and the best first half for a presidential election year on record. That doesn’t mean it makes sense to try to time market returns. There’s no guarantee that history will repeat in 2024, so investors should always have a well-defined investment plan and maintain a long-term focus on managing risk and reward in the financial markets.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1675AO