Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

The legend of “Magnificent 7” continued to grow in the first quarter—along with the performance gap between these stocks and the rest of the market. Since January 2021, these seven stocks—Apple, Microsoft, Alphabet (Google), NVIDIA, Amazon, Meta Platforms (Facebook), and Tesla—have ridden ahead of the S&P 500® Index, leaving the remaining 493 stocks behind.

Investors may now expect these hard-charging equities to continue their run longer. Still, their performance over the past few weeks—where the Magnificent 7 have lagged the broader stock market—shows the danger of putting too much belief in this narrative.

Since the start of 2024, the Magnificent 7 stocks haven’t been trading as a monolith. That’s good news for investors waiting for market performance to broaden from last year’s concentrated level. In Q1, three of the Magnificent 7 underperformed the S&P 500, with two stocks (Apple and Tesla) declining over the three months.

One could interpret this recent split from the narrative as a potential shift in focus to fundamentals, a departure from the previous enthusiasm for all things artificial intelligence. This shift could lead to a pronounced reversion to the mean for the Magnificent 7, where their performance backtracks to longer-term averages. The remaining 493 stocks may see a less severe correction, depending on whether earnings growth in future quarters can validate current valuations.

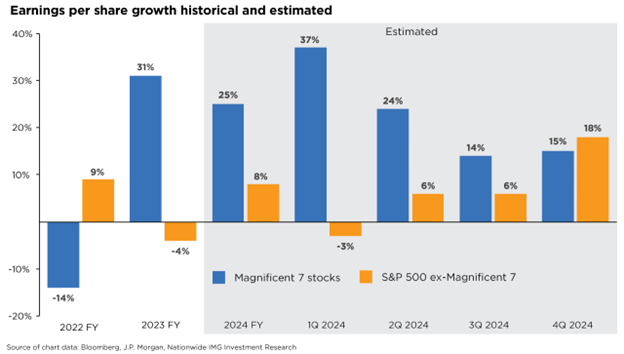

It’s worth noting that the Magnificent 7 have done well in the last two years because of their superior earnings-per-share growth relative to the broader market. However, as shown in the accompanying chart, this advantage could decrease in 2024 and even more significantly in 2025. That could result in a more sustainable rotation, where the other 493 S&P 500 stocks broaden their participation in market gains. This would be a positive development for investors looking to diversify away from the recent market leaders.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1622AO