Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

In my weekly capital markets review, I cover the factors that have influenced market movements, share insights on stock market performance, and connect the dots on key events to watch for in the upcoming weeks.

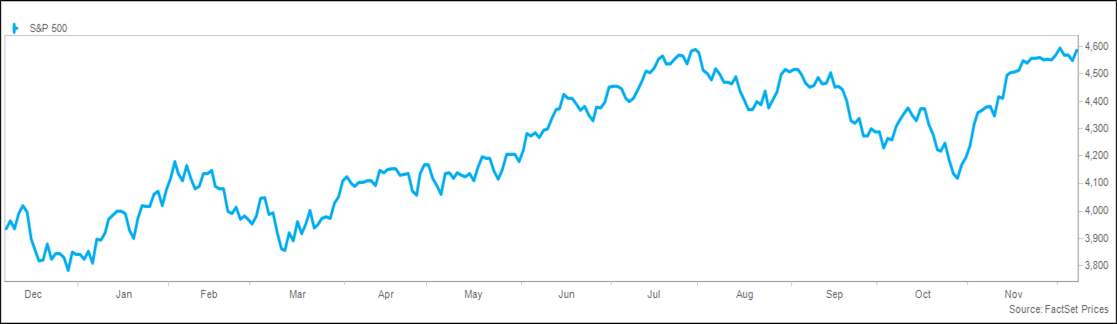

Equity markets were mixed, with the S&P 500® Index managing a modest gain to extend the winning streak to six weeks. A pause following the 12% rally since late October is not unexpected or unhealthy, but the modest gain is encouraging. The S&P 500 is hovering near the best level of the year, with strong seasonal momentum teamed with continued hopes for a soft landing. The complexion of the market continues to subtly shift, with small caps outperforming large caps by 5% over the last month. The encouraging employment report, falling interest rates, and easing commodity prices continue to support markets, though there are increased questions around the sustainability of the rally given developing clouds on the macro picture. Market momentum continues to be a tailwind, with strong November and December seasonality continuing the historical pattern. The rally has been driven largely by technicals, though resilient economic data, modestly improving earnings estimates, and improving financial conditions could provide a fundamental backdrop as well.

As the market rally continues, so does the shift in investor sentiment and positioning. November saw an impressive contrarian rally, as many sentiment and positioning indicators were significantly pessimistic, and financial conditions were at the tightest level since the market bottom last October. Those conditions have shifted dramatically, with Goldman Sachs data showing CTAs shifting from short to long due to record buying in November, and Deutsche Bank data showing systematic strategies moving from below neutral to modestly above neutral, driven by buying of small caps. Bank of America’s Bull & Bear Indicator rose from 2.7 to 3.8 in the latest week, the biggest jump since February 2012, though it does remain below neutral.

November payrolls rose by 199,000, stronger than the 175,000 estimate and last month’s 150,000. Private payrolls were sharply higher than October, registering 150,000 versus 85,000, with significant volatility in growth this year. The unemployment rate was down 0.2% to 3.7%, better than the consensus estimate of 3.9%. Average hourly earnings rose 4.0% versus a year ago, the slowest pace since June 2021, but exceeding CPI for the sixth straight month after real wages were negative for the previous 25 months. The labor force participation rate ticked higher to 62.8%, the best level since before the pandemic. Earlier in the week, the JOLTS report reflected job openings of 8.7 million, below the estimate of 9.3 million and the slowest pace since March of 2021, but still well above the 6.3 million level of unemployed individuals.

Strong consumer data continues to defy economists’ estimates, highlighted by a strong reading on consumer sentiment from the University of Michigan. The index reading of 69.2 was well above November’s 61.9, with current conditions at the best level since August and forward inflation expectations at the lowest level since March 2021. Falling oil prices have been a tailwind for sentiment and consumer budgets, with crude falling for the sixth time in seven weeks and testing the $70 level. Early reads on holiday spending have been encouraging, with the National Retail Federation noting a record 200 million consumers shopping on Black Friday, while Adobe reported online shopping growth of 8% from a year ago during the early stages of the holiday season. A number of retailers have noted on recent earnings calls that November trends have improved after some softness in September and October.

Next week could be a critical one for markets, given the FOMC meeting and the reading on consumer price inflation. The FOMC meeting is not expected to have any fireworks, with the Fed Futures curve embedding virtually no chance of either a hike or a cut. The update to the Summary of Economic Projections will be closely watched, as the September data showed an expected Federal Funds rate of 5.1% at the end of 2024 (reflecting two 0.25% cuts), while the curve implies a rate of 4.2%. CPI is forecast to come in at 3.1% and core CPI at 4.0%.

Equity markets took a breather following an impressive rally since late October, with the S&P 500® Index fractionally higher for the week, the NASDAQ up 1%, and the Dow little changed. Small caps solidly outperformed large caps, while growth beat value. Leading sectors for the week included communication services, consumer discretionary, and technology, while energy, materials, and consumer staples lagged. Volatility continued to be very low, with the VIX closing below 13 for the third straight week, while trading volume was light.

Global markets were sluggish on central bank uncertainty and concern over China’s economy, with the MSCI EAFE and Emerging Market Indexes both lower for the week. In Asia, markets were weak on economic sluggishness, with China and Hong Kong down 3% and Japan down 2%. Europe was mostly higher on increasing expectations that the ECB would cut rates earlier than expected, with Germany and France up more than 1%, Italy and Spain up less than 1%, and the UK down 1%. Latin America was lower on falling oil prices, with Brazil down 2% and Mexico flat. The trade-weighted dollar index rose on higher interest rates.

Commodity prices continued their period of weakness, with the S&P Goldman Sachs Commodity Index down 3% for the week and down 13% year to date. Crude prices fell for the seventh straight week, losing 4% on global supply worries and falling Chinese demand, while natural gas fell 9% on warm conditions. Precious metals fell sharply, with silver down 10% and gold down 4%. Agricultural commodities were mixed. Interest rates were modestly higher for the week ahead of the FOMC meeting, with the 10-year Treasury yield up 0.3% to 4.23%. The 2-year was higher by 0.17% to 4.71%, resulting in further inversion of the yield curve. Credit spreads were modestly tighter.

Investor sentiment and positioning both continued to improve in the latest week. Equity funds and ETFs attracted $6.2 billion in the latest week, though US growth funds saw the largest outflow since December 2021. Flows into bonds were essentially flat, with Treasuries showing the largest outflow since August 2022 at $4.8 billion offset by inflows into investment-grade bonds at the best level since July at $6.1 billion. Money market funds had their best week since March at $93 billion. Sentiment was little changed for the week, with the AAII Sentiment Survey showing bulls down modestly at 47%, while the CNN Fear & Greed Index was unchanged at 67 on a scale from 0 to 100.

The FOMC meeting and the reading on CPI will be the primary areas of focus next week, on Wednesday and Tuesday, respectively. Other notable data include the NFIB Small Business Index on Tuesday, PPI on Wednesday, retail sales on Thursday, and industrial production and PMI data on Friday.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1563AO