Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Stocks defied Wall Street strategists’ pessimistic outlooks at the beginning of the year, delivering one of the strongest first-half performances in many years and rewarding investors who stuck with their stock holdings despite the expected gloom. In early January, many market watchers forecasted a market decline for the coming year due to an imminent recession and decelerating economic activity. Both have failed to materialize this year, at least as of this writing. Instead, the S&P 500® Index rallied for its most substantial first-half gain since 2000. For the NASDAQ Composite Index, it was the best first half in 40 years. For the top 100 stocks in the Nasdaq, it was the best first half ever.

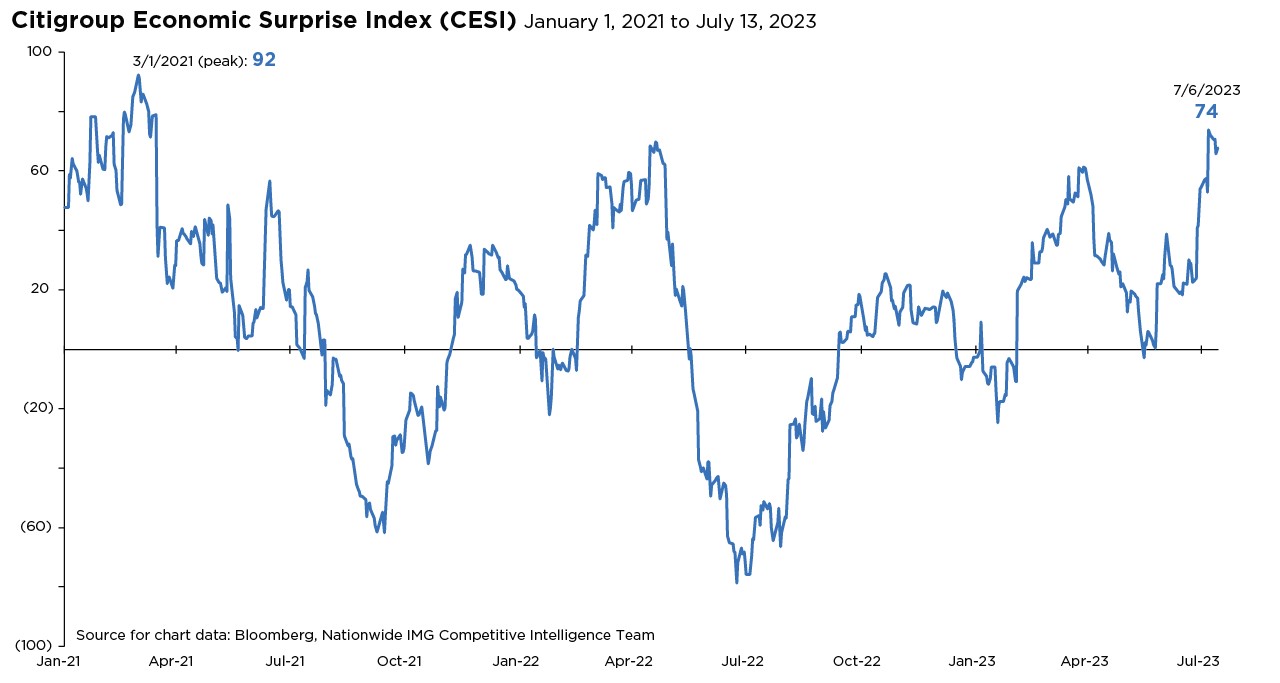

A crosscurrent of economic activity has challenged the pessimism of the market bears, as illustrated by the Citigroup Economic Surprise Index (CESI), which tracks whether a core set of economic data series has been coming in under, at, or over expectations. Coming into 2023, strategists have been overly negative, yet the CESI is currently at a 28-month high as economic data confound the leading indicators, beating expectations in magnitude and breadth.

Ironically, even as favorable economic data squelches the bearish narrative, Wall Street strategists are sticking with their cautious equity views for the second half of 2023. As the chart illustrates, forecasts vary widely among strategists, but on average, they expect the S&P 500 to fall around 8% from July through December. Although the third quarter of the year has historically been the worst quarter for equities, since 1999, there were four other years when analysts had forecasted negative second-half returns. The actual returns in those years saw an average gain of over 12%.

This track record highlights the peril of market timing based on targets. Furthermore, with the second-quarter earnings season underway, a strong CESI is generally a positive signal for earnings, challenging the overly pessimistic view of strategists. The performance of stocks over the first half of 2023 should remind investors why timing the market or setting investment allocations based on market prognostications is rarely a successful strategy.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

NASDAQ Composite Index: A stock market index of the common stocks and similar securities (e.g. ADRs, tracking stocks, limited partnership interests) listed on the NASDAQ stock market.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1491AO