Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

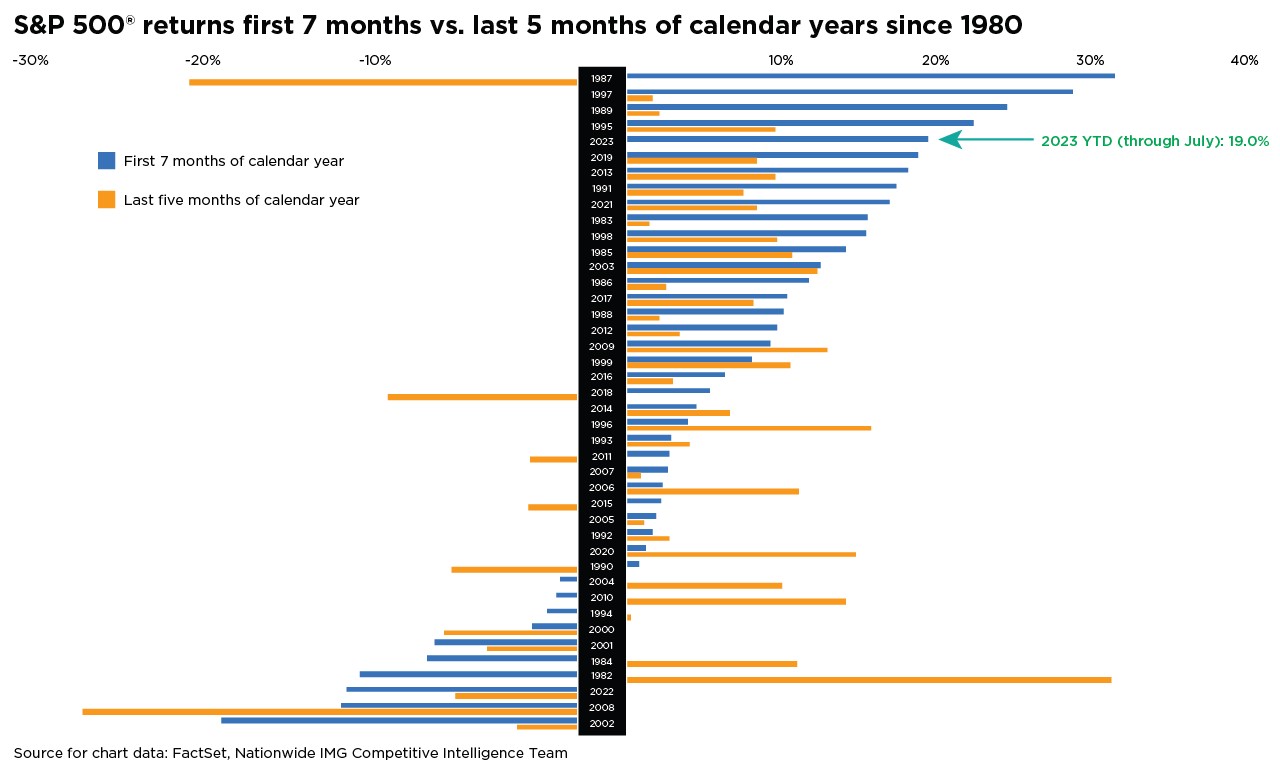

Over the last five months, the S&P 500® Index has demonstrated remarkable resilience, defying overly bearish sentiment in the stock market during the first half of 2023 to surge nearly 20% for the year to date through July. The soft-landing narrative for the economy continues to evolve, bolstered by recent robust data, receding inflation, and rising expectations that the Fed’s rate-hiking campaign is near its end. Investors shouldn’t be disheartened if the stock market weakens slightly in the coming months. Historically, August has been challenging for stocks, ranking third worst since 1950, ahead of only February and September. With September being the worst month for stocks, according to historical data from the Stock Trader’s Almanac, we’re entering what could be a rocky spell for performance among stock investors.

While any weakness that materializes in the coming weeks may catch some investors by surprise, it’s essential to remember that modest pullbacks have historically been common during these two months and shouldn’t be alarming. Any market-wide withdrawal may present buying opportunities for long-term investors. Volatility is an inherent aspect of the market, even during typically strong years for returns, and investors must avoid overreactions and making emotional investment decisions.

The accompanying chart offers an encouraging analog for investors to consider. The S&P 500’s 19% year-to-date return through July was its fifth-best seven-month period to start the year since 1980. In those years where the first seven-month return was greater than 6%, the remainder of the year was positive (with 1987 being the one exception) by an average of 5.4%. Historical data since 1928 shows that the S&P 500 has increased, on average, 2.3% in the last five months of the year, with gains occurring 71% of the time. Investors should recognize that seasonal headwinds or market prognostications are not the bases for a prudent investment strategy. Instead, periods of market weakness are good times to reassess risk tolerance.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1500AO