Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

With the S&P 500® Index continuing to defy gravity—the U.S. stock benchmark has logged gains in 14 of the last 15 weeks—and market breadth receding, investors may be feeling a sense of déjà vu, hearing echoes of last year’s narrow market leadership and uncertain economic backdrop in the first quarter of 2024. The current divergence in the market is reminiscent of 2023’s divided performance, including dismal participation from small caps (at least so far this year), a regional bank stirring contagion fears like Silicon Valley Bank (this time, it’s the New York Community Bank), and the recent performance of the “Magnificent Seven” stocks which led most gains for the S&P 500 in 2023.

For an excellent example of this lop-sided performance, consider that last Friday’s 1.1% gain in the S&P 500 was driven by two Magnificent Seven “Generals”—Meta Platforms and Amazon. The question for most investors right now is like the one they faced in 2023: Will the tech titans continue to carry the stock market, or will the rally broaden with more stocks, leading the market higher?

As the S&P 500 continues to climb toward new all-time highs, the percentage of S&P 500 stocks above their 50-day moving average remains around 50%, reflecting some loss of the momentum that had lifted the market over the past few months. Investors should also know that February has historically been a lackluster month for stocks, especially during election years. Moreover, stretched sentiment and positioning might usher in some market volatility, causing the market to consolidate soon.

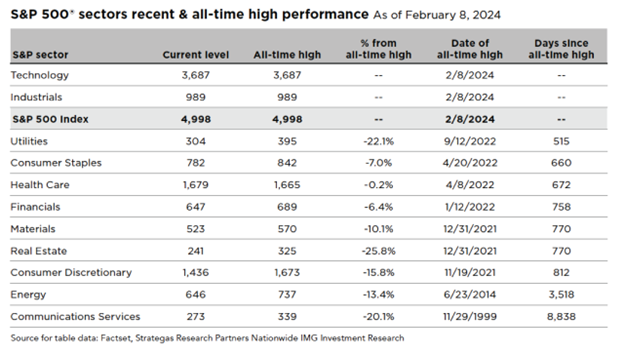

While all eyes are fixed on tech giants during this recent rally, investors might overlook other market sectors with long-term growth potential waiting to shine. The accompanying table of S&P 500 sector performance shows that the technology and industrial sectors may be at or near all-time highs. Still, most other sectors remain a mile away from their peaks.

From this data, investors can see plenty of room for market performance to broaden to these lagging sectors, especially with a much more constructive economic backdrop. As Q4 earnings season winds down, investors should be encouraged that the percentage of companies reporting double-digit earnings growth is around 43%, which implies the first quarter of 2023 was likely the end of the “earnings recession.” That can provide a bullish tailwind for equities and support broadening market performance for investors with long-term views.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1585AO