Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

As the end of Q4 earnings season approaches, three-quarters of S&P 500® Index companies have reported actual earnings above estimates, according to FactSet, around the 10-year average of 74%. Although this news is encouraging, these statistics raise a critical question for investors: Is it relevant to focus on past earnings beats, or is future earnings-per-share guidance more pertinent?

Focusing on earnings revisions is more informative for investors, as they capture evolving trends that investors who are solely fixed on a narrow set of economic indicators (e.g., Leading Economic Index or inverted yield curves) may miss. Additionally, looking at the stock market’s forward-looking nature reveals the power of earnings revisions in illuminating subtle yet impactful trends lurking beneath the surface of the stock market and the broader economy. In a sense, earnings revisions may be a better barometer of forthcoming shifts or trends.

It took over two years for the S&P 500 to reach a new all-time high after peaking in January 2022. For those who remember the October 2022 bear market low, investor sentiment was dour, and many economists predicted an imminent recession.

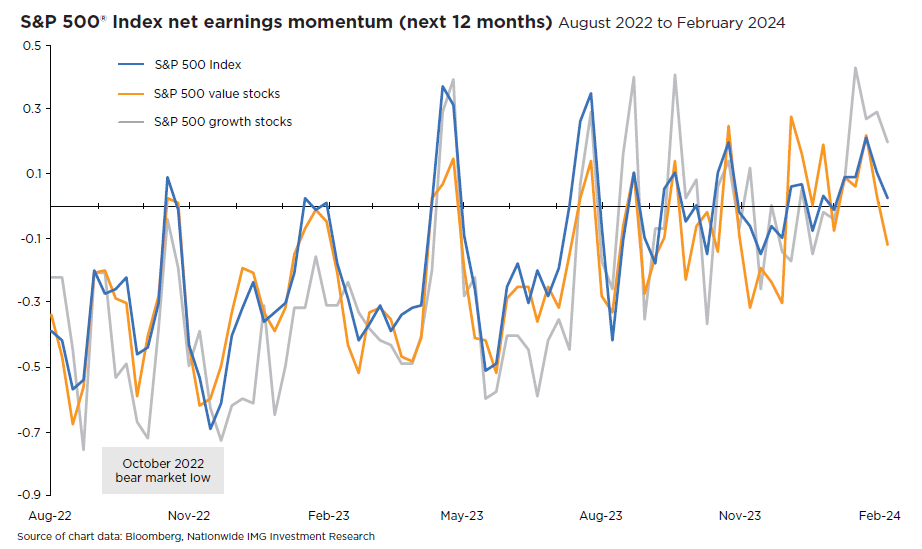

Traditional indicators of an economic slowdown only fanned investors’ bearish fears. However, as seen in the accompanying chart, net revision momentum slowly began to support the S&P 500 during the fourth quarter of 2022. This momentum likely started from the market’s ability to transcend short-term bearish sentiment, driven by the likely convergence of two potent market trends to generate a decent tailwind for the S&P 500.

The first trend consisted of improving forward-earnings growth, escalating capital expenditure investment, and resilient corporate margins. Likewise, the second trend consisted of receding inflation, the indications of future Federal Reserve rate cuts, and improving productivity in the economy. As such, the market’s surprising rise to all-time highs and, more importantly, the gradual increase in earnings revisions have endorsed these trends. Although pullbacks may be expected in any given year, the fundamental backdrop doesn’t support the likelihood of a severe bear market, such as the one we saw in 2022.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1592AO