Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Recently, investors have followed a peculiar logic, greeting signs of slowing economic activity as good news and increasingly embracing risk, leading stock markets to move higher. Bad economic news, such as weakening payroll growth or moderating business activity, should lead to poor market performance in the future because economic growth, as measured by gross domestic product and stock returns, tends to be correlated over the long term.

To see why the markets often react counterintuitively to economic data, investors can establish a framework to understand how good and bad news can influence performance. We can look at this framework as a matrix. For example, “good news is good news” means equity markets and economic data are rising together. “Bad news is good news” means equity markets are rising on falling economic data. “Good news is bad news” means equity markets are falling on positive economic data. Lastly, “bad news is bad news” means equity markets are falling on negative economic data.

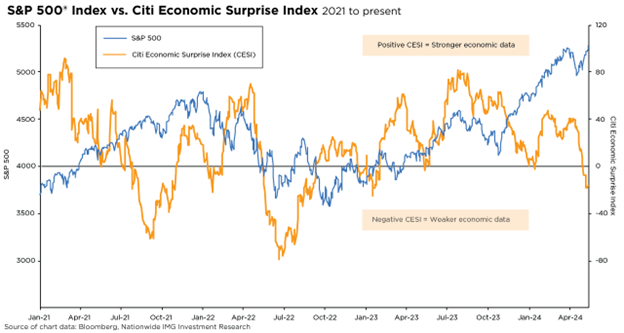

The Citi Economic Surprise Index (CESI) presents a helpful barometer to help explain generally how stocks react to economic surprises over time. A positive reading for CESI means data have been stronger than expected, while a negative reading means data have been worse than expected.

The period between July 2023 and March 2024 offers an excellent example of how to use the above framework to interpret the correlation between the CESI and stock performance. (See the accompanying chart.) In July, market psychology shifted as better-than-expected economic data convinced investors to quell their rate-cut expectations. The S&P 500® Index declined from August through October in this “good news is bad news” scenario.

As the equity market declined through the end of October, economic data moderated and calmed fears that the Fed would reduce interest rates in 2024. This “bad news is good news” scenario helped the S&P 500 establish a bottom in October 2023 on which to start an impressive year-end rally.

In 2024, “good news is good news” emerged with positive news on economic growth, resilient consumer spending, and progress on taming inflation (although at a slow pace), supported the “Goldilocks” narrative, and contributed to the S&P 500’s 10% gain for Q1. But toward the end of April, the market embraced “bad news is good news” again as a slew of weaker economic data helped to reduce interest rates and bolstered the case for Fed rate cuts. The S&P 500 climbed to new heights as investors again warmed to risk.

If economic data continues to moderate, will we eventually see the one scenario we haven’t seen lately: “Bad news is bad news?” That would blunt the enthusiasm for risk, but it also highlights why investors should continue to invest for the long term.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1642AO