Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

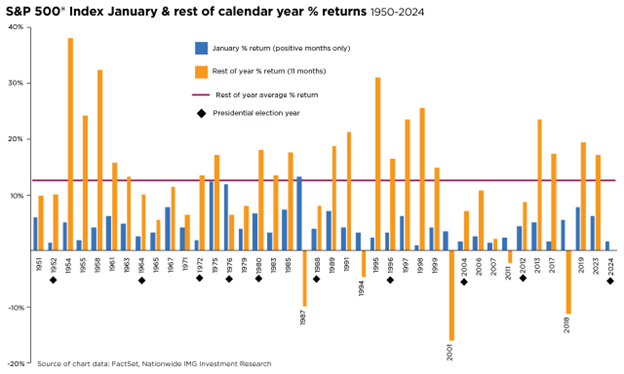

A positive month for stocks to start the year may be a good sign for the rest of 2024, even though many market strategists and reluctant bears still expect turbulence as investors wait for rate cuts from the Federal Reserve. While the Federal Open Market Committee stood pat on rates at its January 31 meeting and Fed Chair Jerome Powell doused expectations for a March rate cut, the S&P 500® Index finished a turbulent January with a 1.6% return.

Such a small monthly gain might generate little fanfare, given the substantial 17% rally for the S&P 500 from the October 2023 low through the end of last month. However, January is often an early seasonal indicator of what is likely (although not guaranteed) for the remainder of the year. According to an old Wall Street saying, “As goes January, so goes the year.” Many stock market bulls are looking toward the rest of 2024 for positive returns.

This longstanding adage might seem like wishful thinking or folklore espoused by the bulls, but there is some validation for it in the historical data. As the accompanying chart illustrates, a positive January has meant gains for the S&P 500 for the remaining 11 months of the year in about 85% of the time since the 1950s, with an average gain over those 11 months of about 13%. Moreover, a positive January in a Presidential election year (like 2024) is often a bullish sign for stocks for the rest of the year.

This “January omen” is encouraging, but investors should remain aware of potential market volatility. The recent backdrop of supportive economic data, such as moderating inflation and better-than-expected economic growth, should support financial market gains. However, investors should remember the perils of timing the market or making investment decisions based on adages and folklore. Instead, a strategy tailored to an investor’s goals, time horizon, and risk tolerance is ideal for an individual seeking long-term financial goals.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1581AO