What lies beneath the stock market’s record run?

The stock market's run of all-time highs is good news for investors, but there's cause for concern below the surface.

Key Takeaways:

In recent financial markets news, you may have noticed that small-cap stocks have taken a bit of a backseat to their large-cap counterparts, particularly the “Magnificent 7” large-cap stocks which have dominated the news cycle given their performance as of late.

In fact, while the S&P 500® Index recorded nearly two dozen all-time highs for the year-to-date during the early part of 2024, the S&P SmallCap 600® Index got off to a slow start over that same stretch.

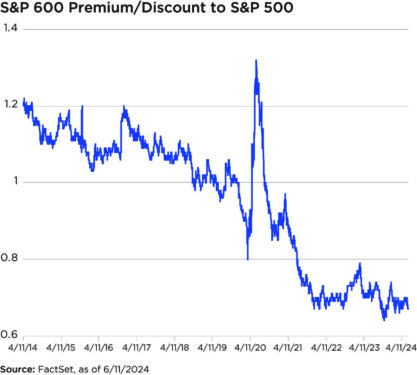

By the end of April 2024, the S&P SmallCap 600 was trading at an approximate 30% discount to the S&P 500. As a result of this attractive valuation, small caps offer long-term investors some potential opportunities for growth—especially those investors seeking to diversify or rebalance their portfolios following significant appreciation of their large-cap holdings.

And, given their historical track record of delivering strong absolute and relative performance through multiple market cycles, small-cap stocks may be worth an even closer look.

This all spells good news for long-term investors, despite the ever-changing outlook for monetary policy easing and inflation, which both present inherent risks for smaller companies. However, thanks to the continued resilience of the U.S. economy, fears of economic recession are being tempered and we should expect to see above-trend growth as a result, which is favorable for those same smaller companies.

From our viewpoint, there are four different catalysts emerging in the current market cycle that are likely to create a favorable climate for investing in small-cap stocks.

All that to say, recent developments with weakening economic data have led many to believe that a potential rate cut is on the horizon, which would serve as a catalyst for small-cap stocks—offering long-term investors a greater potential for growth in the latter half of the year and into 2025.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P SmallCap 600® Index (S&P 600): a stock market index established by Standard & Poor’s that covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFM-24024AO