What lies beneath the stock market’s record run?

The stock market's run of all-time highs is good news for investors, but there's cause for concern below the surface.

Throughout the first half of 2024, investors had to parse different signals and indicators to understand where markets were headed and how to position their portfolios. Although the U.S. economy demonstrated more resilience than expected, some reports were at crosscurrents. Conflicting data on inflation, GDP growth, employment, consumer spending, and sentiment showed that the path toward a “soft landing” would be anything but linear.

Ultimately, financial markets found their way, as economic activity remained more resilient than most believed. The best approach to the markets during the first half of the year was to stick with what worked since the bear market low of last October—namely large-cap growth stocks, specifically the mega-cap “Magnificent 7” stocks. At the end of June, the S&P 500® Index was up more than 15% since the start of the year, marking multiple all-time highs. (31 for the first six months of 2024.) In the bond market, interest rate volatility and uncertainty around the path of monetary policy weighed on fixed-income investors. However, toward the end of April, interest rates gradually eased as lower inflation readings increased the likelihood that the Federal Reserve would begin to cut interest rates before year-end.

As the year began, many market participants expected the headwinds of high inflation and high interest rates would finally hit the U.S. economy and cause a modest slowdown. However, economic activity proved to be more solid than anticipated. That, in turn, helped prop up corporate profits and, by extension, the equity markets.

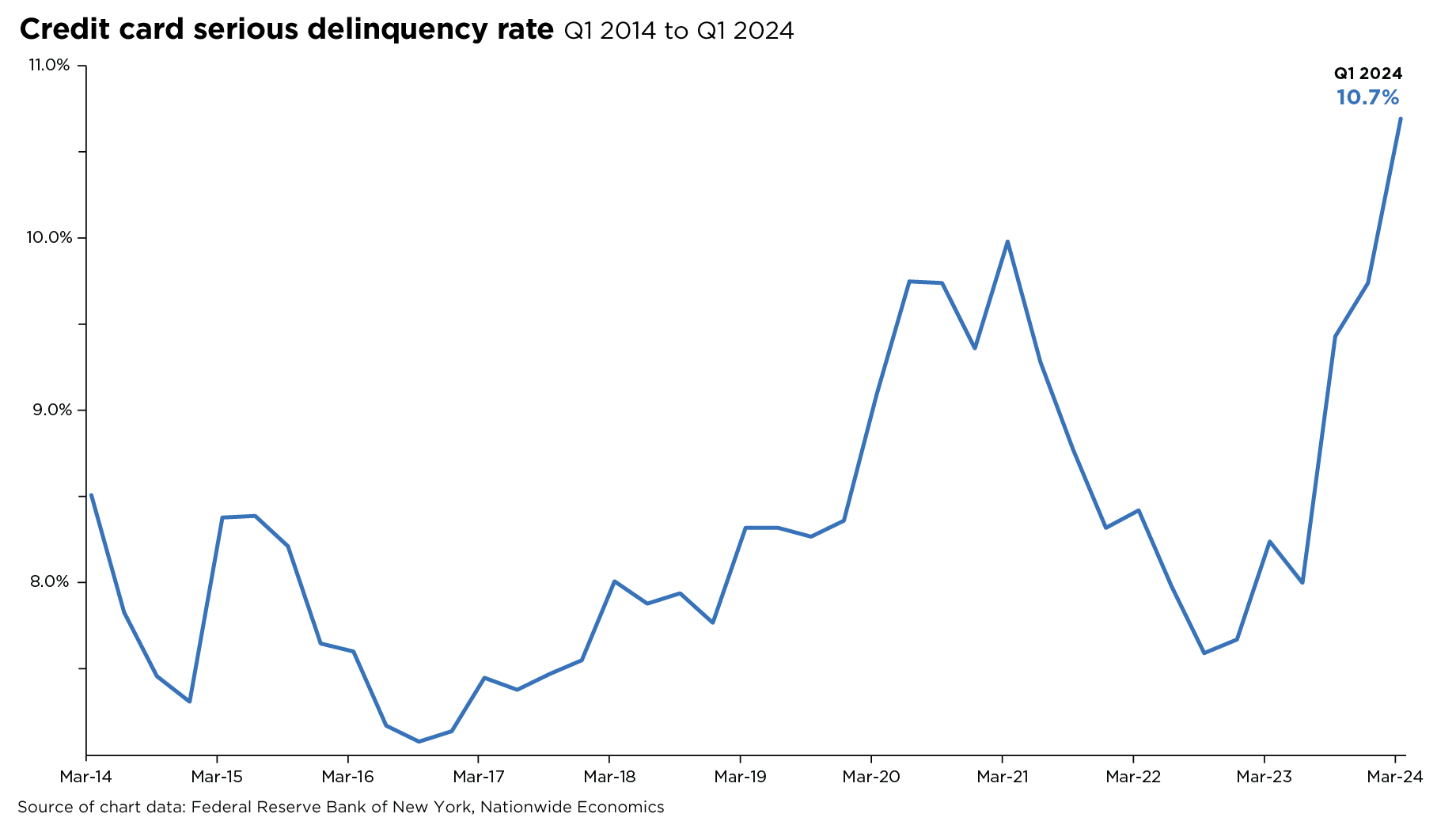

The “wealth effect” created by rising stock prices and a healthy labor market propelled consumer spending, consistently contributing to growth in the year’s first half. Consumers sustained spending as the after-effects of the pandemic have dwindled, primarily by drawing down savings and racking up credit card debt. We are back to normal, with spending patterns tied to current income and job prospects. A moderation or slowdown in employment growth could cause a ripple effect in consumer spending. We’ve seen some signs of this in the recent sharp rise in credit card delinquencies, a more typical occurrence during a recession, so it’s an indicator that bears are watching.

The downside of faster-than-expected economic activity has been a renewed acceleration in inflation. The Consumer Price Index posted substantial gains in Q1, particularly for services and housing. Inflation trends were more encouraging in Q2, with price increases for goods turning deflationary, but the overall rate remains above the Fed’s 2.0% target. Still, inflation remains the most significant drag on the economy and the focus of both the Federal Reserve and consumers. However, we are cautiously optimistic that the encouraging trends will continue, and prices should come down in the second half of the year, eventually creating room for a reprieve on interest rates.

The stronger-than-expected start to 2024 pushed out the timing of Federal Reserve interest rate cuts. At the beginning of the year, most estimates showed 5-6 rate cuts in 2024, but as we know, the Fed has stood pat so far this year. At this midpoint, consensus expectations project the Fed to cut rates only once or twice by year-end. As of this writing, inflation will likely cool enough in the coming months to allow for a quarter-point cut in September and another in December.

This interest-rate cycle is much different than previous cycles when the Fed acted slowly to hike rates and then quickly to cut rates. The central bank has taken the opposite tack this time; rates were swiftly hiked—at the fastest pace of tightening since the early 1980s—and we expect cuts to happen slowly. The risks are pointed to a later start to the easing cycle, which could even be delayed into 2025. We expect monetary policy to remain restrictive into next year and for the Fed to be more cautious than usual when gradually lowering the federal funds rate to ensure that inflation returns to trend.

Global interest rates have likely reached their zenith in this economic cycle and are expected to gradually decline as various central banks shift towards implementing rate cuts this year. While there is no immediate urgency for the Federal Reserve to cut rates, the Federal Reserve won’t be far behind in initiating policy normalization. As a result, both short—and long-term bond yields are likely to see a gradual decrease over the next 12 months. We believe investors should understand that rate cuts will not result in the low interest rates of the past 15 years when the Federal Reserve implemented unprecedented monetary policy easing. Instead, we think the rate-cutting cycle will be slow and methodic, as Fed Chair Powell noted at the June FOMC meeting, stating that the risks are now two-sided when considering an adjustment to the target fed funds rate. From our perspective, as the Fed begins to cut rates, investors sitting in cash will face reinvestment risk. If short-term yields fall when the Fed starts to lower rates, then the 5% yields enjoyed by investors over the past year will not be available when it’s time to reinvest. Therefore, reinvestment risk at lower rates in the future is a risk that investors must consider in their short and long-term planning.

After last year’s 26% rise in the S&P 500® Index, many market analysts anticipated 2024 would be a weak year for stocks with heightened volatility. Neither of those projections came to fruition, at least through the year’s first half. The S&P 500 delivered an impressive return of 15.3%, making it one of the top three first-half returns of the last 25 years. Further, there hasn’t been a move of more than 2% for the S&P 500 in 18 months, the longest such streak since the pandemic, and sentiment indicators show that many stock investors feel bullish but not to extreme levels. All these factors have created a constructive backdrop for stock market gains.

We view any period of equity market weakness as an excellent opportunity for investors to add risk, given our favorable outlook for earnings into 2025. Two favorable trends support this outlook. First, S&P 500 net margins improved across eight of the Index’s 11 sectors in the first quarter of 2024 compared to the first quarter of 2023, a positive indicator of the bull market’s potential longevity. Moreover, first-quarter earnings have laid the foundation for what we believe will likely be respectable growth in every subsequent quarter for 2024, with all 11 S&P 500 sectors on pace to deliver earnings growth year-over-year by the end of 2024. Second, aggregate S&P 500 EPS estimates have remained unchanged year-to-date (see chart below), which is typically unusual. Generally, as of June of the previous year, consensus estimates normally decreased by an average of 7%.

The outlook for positive economic growth and gradually easing inflation should provide a constructive backdrop for corporate earnings in the year’s second half. We are also cautiously optimistic about the prospect for earnings growth to broaden beyond the “Magnificent 7”, setting up a scenario where market breadth improves, and more stocks participate in the upward trajectory. Equally important, investors should understand that the outlook for the equity markets has risks. For example, economic growth could deteriorate faster than expected, causing top-line revenue and EPS estimates to decrease due to reduced pricing power, waning consumer spending, or margin compression. This could fuel negative investor sentiment and risk-off positioning, pressuring the broader market.

Sobriety is key for investors at this stage of the market cycle. There’s potential for short-term pain, but we expect to be on an upward swing over the longer term. A period of weakness in the equity market wouldn’t be a surprise and could be an excellent opportunity for investors to add exposure to risk.

The upcoming presidential election is a significant event for the near term, but not necessarily because of the outcome. In an increasingly partisan electorate, some investors may be inclined to make financial decisions based on their feelings about either candidate, whether favorable or unfavorable. However, history shows no correlation between political party control in Washington, D.C., and investment performance on Wall Street. Therefore, it’s crucial for investors to remain vigilant with their emotions and leave them out of the investment decision-making process during these upcoming months, making rational decisions based on market analysis and not political sentiment.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

NFN-1671AO