Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

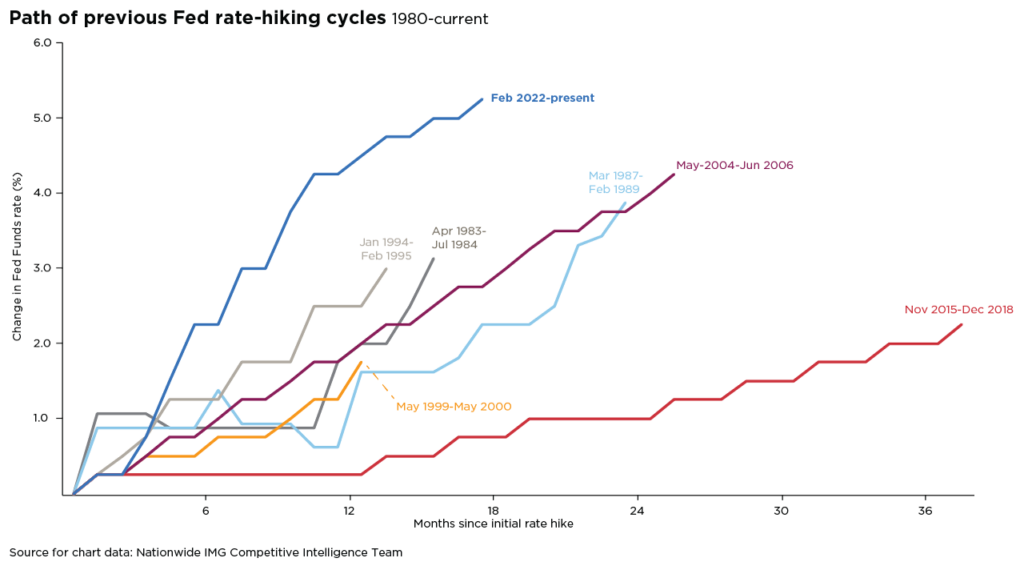

Of all the Federal Reserve rate hiking cycles over the last 40 years, the current cycle has been both the largest (in terms of cumulative rate hikes, at five percentage points) and the fastest (almost 18 months.) That’s as of June 1st, so it’s possible more hikes may come down the road. Fed watchers see potential for a pause on this cycle of rate increases at the next FOMC meeting on June 14, but with some recent reports showing an economy still running hot, there’s a case for no pause and more hikes coming from the Fed in the foreseeable future.

Small and midsize business owners—who arguably are more tuned-in to the current state of their local economies than central bankers stationed in Washington—have seen first-hand the impacts of higher interest rates to their bottom lines and are worried about a further squeeze in business conditions. In a recent Nationwide economic impact survey of small and midsize business owners, over half said rising interest rates have negatively impacted their businesses, with small business owners reporting the biggest negative impact over the past year.

In the next months, both midsize and small business owners expect inflation and rising prices to pose the biggest challenges to their businesses. Small business owners are expecting a bigger challenge from rising interest rates as well, as compared to where those expectations were last year.

Some of the more optimistic investors who are looking for the Fed to pause the current rate hike cycle base their case on the past rate-tightening campaigns over the last 40 years. (See the accompanying chart.) On a few occasions, the Fed has lifted rates over the course of two years and even three years once, implying that the current cycle may be in its final stages and a rate pause or even a rate decrease could be in the cards before year-end.

Adding five percentage points to the Fed funds target rate so quickly would undoubtedly have some effect on business conditions. The central bank noted as much in the minutes from the May meeting for the Fed’s rate-setting committee: “Tighter credit conditions for households and businesses were likely to weigh on economic activity, hiring, and inflation. However, participants agreed that the extent of these effects remained uncertain. Against this background, participants concurred that they remained highly attentive to inflation risks.”

While the Fed and business owners are paying attention to tighter credit conditions, the actual economic impact isn’t quite reflected in the data, at least not yet. For one, the Fed’s preferred inflation gauge—the Personal Consumption Expenditures (PCE) Index—remains more than twice the central bank’s preferred rate, at 4.7% year-over-year. Many economists agree that getting inflation down to 2% won’t be easy. Furthermore, the market’s belief that inflation will have eased enough for the Fed to lower rates by the end of 2023 is premature at best. After the most aggressive rate hiking cycle since 1980, inflation remains a persistent problem for the economy.

Secondly, the Fed’s other mandate—unemployment—is at its lowest level in 54 years. A strong labor market has meant wages have remained sticky and consumer spending solid. That bolsters the likelihood of more Fed rate hikes to come and probably no rate cuts for the time being. This weighs heavily on market expectations, with more volatility possible as the Fed presses on in its inflation fight, trying to cool the labor market and rein in consumer spending.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company.

© 2023 Nationwide

NFN-1468AO