Shifts in stock market leadership can be extreme

Small caps have led the market recently, taking over from large caps. What will it take for the rally to continue?

Last week, Congressional leaders punted once again on funding the federal government, passing a temporary measure that avoids a shutdown and keeps the government running until Congress reconvenes in the new year. The latest agreement set two deadlines in January and February 2024 to pass spending bills for the full fiscal year, which began in October.

Government shutdowns are unambiguously negative for the economy due to delayed services and deferred wages for federal workers. According to the Congressional Budget Office estimates, the partial government shutdown in late 2018 and early 2019, the longest in U.S. history, cost the economy roughly $11 billion. Given that past shutdowns have been short-lived, their economic impacts have been limited, with only minor declines in real GDP growth caused by the disruption to government operations. Federal workers have received lost pay once funding resumed, which eventually evened out the income effects for the economy.

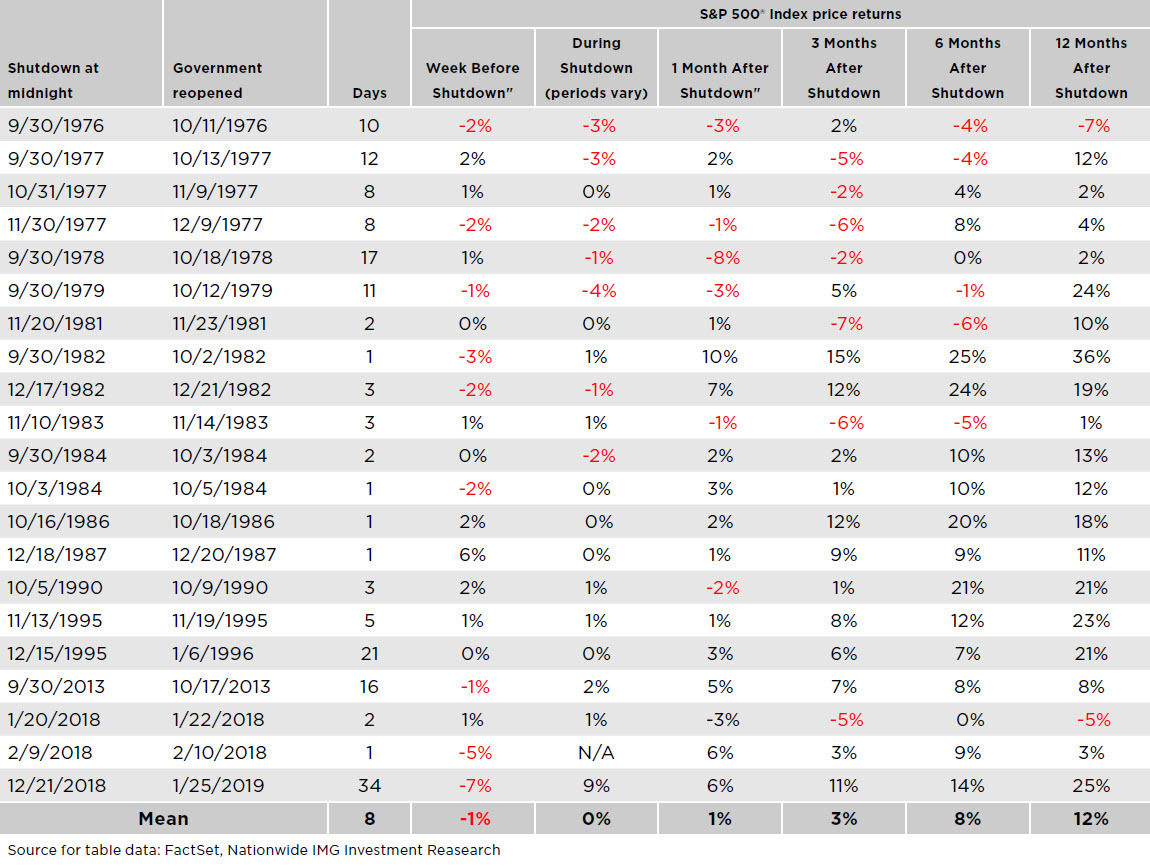

As an investor, all these warnings about the potential risks from government shutdown can weigh on sentiment. The recent positive news on inflation buoyed markets, but concerns remain over the likelihood of an economic slowdown and elevated geopolitical risks. In this pause before the next round of political brinksmanship, it’s an excellent time to consider what a government shutdown could mean for the stock market. The accompanying table shows that past government shutdowns have not significantly impacted the stock returns. From an investor’s standpoint, government shutdowns (or at least the threat of shutdowns) may create anxiety, but they haven’t necessarily sparked a severe downturn in the stock market.

History shows equity markets have been resilient during these periods. For instance, stocks have appreciated in more than half of the previous government shutdowns (when the federal government was closed). And 12 months after these past shutdowns, stocks were higher 90% of the time. But as is the case whenever citing market history, investors should not assume past trends will continue in the future.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should work with their financial professional to discuss their specific situation.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC, member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation, member FINRA, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide

NFN-1552AO