Podcast: US economy’s solid ground despite Q1 GDP slowdown

Discover valuable perspectives on Q1 GDP data insights from Nationwide's Senior Economist Ben Ayers and Economist Daniel Vielhaber.

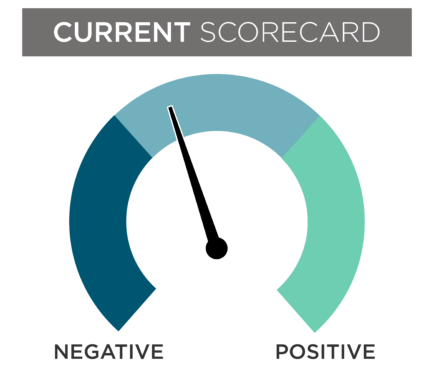

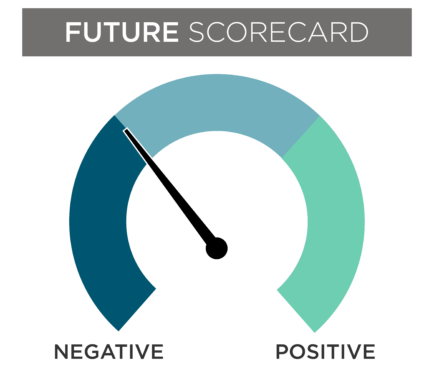

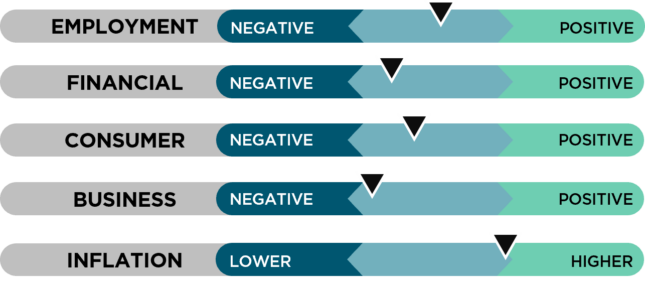

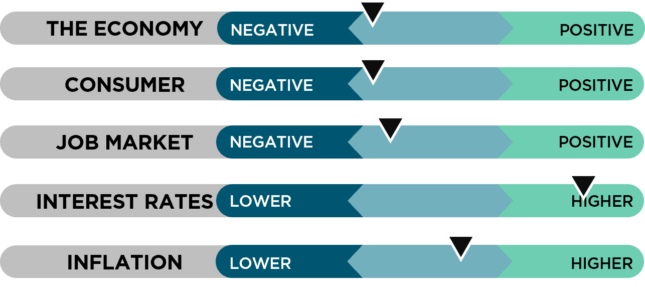

Consumers finished the third quarter strong as the still solid labor market continues to support spending, especially on services. But households are cutting deeper into personal savings and adding to debt, not a sustainable path for spending to remain buoyant in coming quarters. Headwinds for near-term activity are building, including rising interest rates, the resumption of student loan payments, emergent geopolitical concerns, and the potential for a federal government shutdown. This should result in significantly slower economic growth over the fourth quarter, a likely forerunner to a mild recession in the first half of 2024. The strength of recent economic data may even increase the odds of a recession as it reinforces a higher-for-longer rate path from the Fed into the new year.

Much stronger-than-expected hiring and retail spending in September suggest that activity continues to run too hot to meaningfully slow inflation in the near term. This complicates policy decisions for the Fed despite signs that corporate profits are waning in response to even tighter financial conditions and rising interest rates. The way forward for consumers may be tougher, too, as more households are turning to credit with excess savings nearly exhausted and student loan payment resuming. For now, the economy continues to hum along despite the building clouds on the horizon.

Economic growth remained robust heading into the fourth quarter, but headwinds for consumers and businesses continue to build and should slow economic activity sharply before the end of the year. Interest rates have climbed further, stifling the housing sector and business investment, while many households are hitting spending limits with pandemic savings exhausted and debt levels rising. For these reasons, we believe a recession will unfold over the first half of 2024, although the length and severity of the projected downturn should be relatively mild.

The information in this report is provided by Nationwide Economics and is general in nature and not intended as investment or economic advice, or a recommendation to buy or sell any security or adopt any investment strategy. Additionally, it does not take into account any specific investment objectives, tax and financial condition or particular needs of any specific person.

The economic and market forecasts reflect our opinion as of the date of this report and are subject to change without notice. These forecasts show a broad range of possible outcomes. Because they are subject to high levels of uncertainty, they will not reflect actual performance. We obtained certain information from sources deemed reliable, but we do not guarantee its accuracy, completeness or fairness.

Nationwide, the Nationwide N and Eagle, and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide.

NFW-11325AO