10 essential financial planning tips for newlyweds

Explore essential financial planning tips for helping clients merge finances in marriage

Where’s the first place anyone goes to learn something new? These days, it’s the internet. You can Google any topic, follow a hashtag, or find a social media influencer to help you figure out how to do whatever you want on your own.

When I first became a young business professional, I knew I had to change my spending habits as I was leaning heavily on credit cards. So I used the internet to search for how to make a budget and how to pay off debt in an efficient manner. The time I spent on those subjects helped me tremendously in adhering to a strict budget and becoming debt-free.

So, it’s not surprising to discover people going online and on social media to learn more about managing their personal finances. There are many good digital sources for accurate and helpful financial information, but there’s plenty of misinformation on the internet as well.

One of the key findings in the latest Advisor Authority survey, powered by the Nationwide Retirement Institute®, found that many retired and non-retired investors have come across bad financial information online and have unfortunately acted on it. In some cases, this financial misinformation can potentially set investors back from realizing their long-term financial goals.

Because the internet is easy to access for nearly everyone, it makes sense that investors go there first to seek answers to their financial questions. But before we get into the challenges of parsing out money misinformation, we should consider what’s driving investors to know more.

The demand for financial information comes at a time when many people are feeling increasingly stressed about their personal finances. Financial planning struggles can come from different sources—debt overload, lack of savings, and high taxes, for example. Being prepared for retirement is one of the more common concerns.

Many investors report feeling less confident and more uncertain about their financial futures, but we wanted to know how they’re feeling in the present day. In our Advisor Authority survey, we asked investors about any changes they’ve made to their retirement plans due to the financial stressors they’ve experienced.

About four in ten (41%) non-retired investors said that if they retired in the next 12 months they would continue to work in some capacity to supplement their essential income. More than one in four non-retired investors said they would likely need to work in retirement due to inadequate savings.

Additionally, 19% of non-retired investors have changed their retirement plans in the last 12 months and are currently planning to retire later than planned. That’s almost double the number of non-retired investors who said they have changed their plans in the last 12 months to retire earlier than planned (10%).

Financial stress can quickly compound to leave investors wary, confused, and vulnerable to making bad decisions with their money and savings. So, it’s understandable they’d turn to online sources to get more informed and make better financial decisions. However, the prevalence of financial misinformation online makes it likely investors run into trouble by following bad advice.

In recent years, social media platforms have emerged as the go-to source for getting information on nearly every topic, not just for money and finances. On these platforms, investors can get #financetips to help them increase their #financialliteracy about #retirementplanning, so they can #invest their #money for #financialfreedom. Additionally, on social media, they can get money tips from a growing army of “fin-fluencers” – everyday people offering financial advice to anyone who listens.

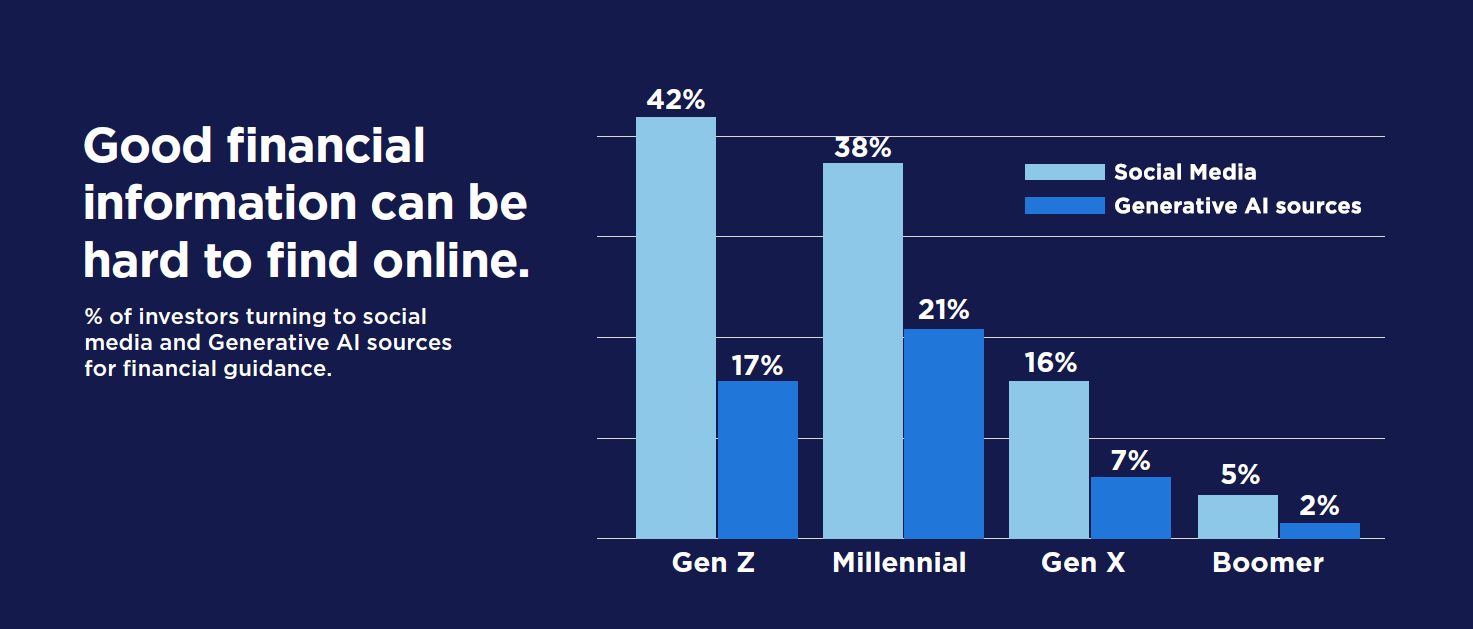

Generally, it’s investors from younger generations who are more inclined to seek out financial information on these social platforms. That’s not surprising given that many Millennial and Gen Z investors grew up online. Our survey confirmed this trend; nearly two-fifths of Gen Z (42%) and 38% of Millennial investors have turned to social media for financial guidance, with usage dropping significantly among older generations.

Additionally, with all the interest in artificial intelligence (AI), we wanted to see how open these digital natives are to AI-generated financial advice. In general, the same pattern of usage emerged—around 20% of Gen Z and Millennial investors reported using generative AI platforms for financial information and guidance, much greater than Gen X and Boomer investors.

This is not to say any financial information found on social media and generated by AI is bad. There’s a lot of good financial advice to be found online, but it’s also not hard to come across financial misinformation.

More than a third (34%) of non-retired investors aged 18-54 in our survey said they’ve encountered and then acted on financial information seen online or on social media, only to discover later that info was misleading or factually incorrect. And because younger investors may be more likely to seek out financial guidance on social media, they also reported higher rates of acting on money misinformation than older investors.

This presents an opportunity for financial professionals to step up and demonstrate value by offering a clear and objective view that sorts the good financial info from the bad and being a voice of calm when financial stressors make investors more anxious and fearful. That’s something that any “fin-fluencer” would struggle to achieve, and what can set a financial professional apart from the crowd.

Taking on the issue of money misinformation is a great place for financial professionals to start. Our survey found many are already doing this; 58% of financial professionals said they already talk with clients about the risks of misinformation on social media and AI platforms.

Investors shouldn’t be discouraged from learning more about financial planning on their own. An informed client can be a more engaged client, so encourage them to seek answers to their financial questions from reliable sources.

As a financial professional, your role in your client’s financial education can confirm the good lessons they’ve learned and clear up the confusion that financial misinformation can create. While the “fin-fluencers” cater to the masses with “one-size-fits-all” financial guidance—which often can be inaccurate or not suitable for many investors—you offer clients personalized “one-on-one” direction that’s tailored to their specific financial needs.

It can also be helpful for you to tap online sources of good financial information, including social media and generative AI platforms. Even with the uncertainty surrounding artificial intelligence, many financial professionals expressed openness toward using AI in their practices; 31% in our survey said they’re considering implementing AI into their advising practice in the next 12 months to generate data insights, while 27% plan to use AI-generated content in their client education efforts.

However you decide to bring online and digital financial information into your process, it’s important to keep the personal touch that adds real value to your client relationships. AI and social media is changing the world, and we need to change with the technology. These advances won’t replace your role as a trusted provider of financial insight and guidance, but you can use it to enhance the relationships you have with your clients and help them stay informed about their financial plans.

The research was conducted online within the U.S. by The Harris Poll on behalf of Nationwide from August 14-30, 2023, among 507 advisors and financial professionals and 2,404 investors ages 18+ with investable assets (IA) of $10K+. Advisors and financial professionals included 274 RIAs, 196 broker-dealers, 143 wirehouse and 52 other financial professionals. Among the investors, there were 636 Mass Affluent (IA of $100K-$499K), 529 Emerging High Net Worth (IA of $500K-$999K), 402 High Net Worth (IA of $1M-$4.99M) and 219 Ultra High Net Worth (IA of $5M+), as well as 618 investors with $10K to less than $100K investable assets (“Less affluent”). Investors included a subset of 464 “pre-retirees” age 55-65 who are not retired.

NFM-23477AO